Key takeaways:

-

A veteran trader sees a potential 60% rally toward $4.47 in the coming months.

-

XRP’s strongest weekly gain since November and record whale accumulation signal growing institutional confidence.

-

Onchain sentiment shows XRP transitioning into the “belief–denial” phase.

XRP is preparing for a major price breakout, according to veteran chartist Peter Brandt.

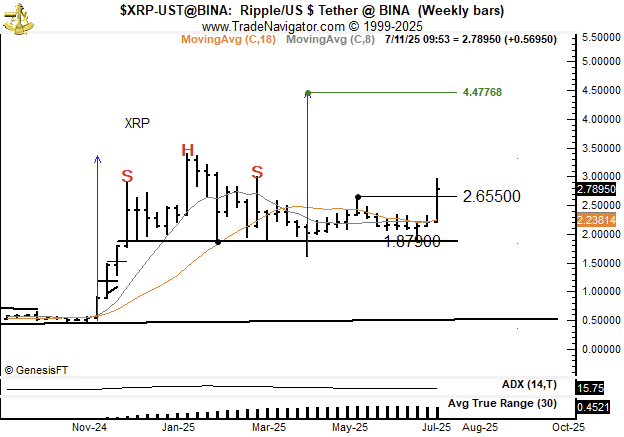

XRP could rally toward $4.47 next

In his latest XRP chart update, Brandt highlights a “highly rare continuation compound fulcrum” setup forming on the XRP/USDT weekly price chart, asserting that its resolve could push the pair up by around 60% to $4.47.

The “compound fulcrum” typically resembles a complex base formation, often made of multiple smaller patterns (like failed breakdowns, minor ranges, or wedges) that develop over time.

Each failed move adds to market confusion, shaking out weak hands while stronger players accumulate.

Once that balance breaks, the price often moves toward the underlying trend, typically up if the market is in an overall uptrend. A break below the support line near $1.80 could invalidate the setup, however.

XRP whales back best weekly price gains since November

Brandt’s bullish outlook comes as XRP posts its strongest weekly performance since late November, rising around 25% in the week ending July 13 amid broader crypto market strength.

Supporting the rally, the number of wallets holding at least 1 million XRP has climbed to a record high, suggesting growing confidence among large holders.

Signs of “altcoin season” have further improved XRP’s potential to rally further in the coming months, with onchain data resource Santiment noting:

“As long as Bitcoin can maintain its position above the crucial psychological support level of around $110k, traders will likely feel comfortable redistributing profits into altcoins.”

XRP onchain metric shows no signs of capitulation

Onchain sentiment data is also supporting XRP’s bullish case.

XRP has moved from the “optimism–anxiety” phase into “belief-denial,” a zone that often signals room for more upside, according to Glassnode’s Net Unrealized Profit-Loss (NUPL) metric.

In past cycles in 2021 and late 2020, XRP entered the “euphoria–greed” zone before sharp price corrections.

That isn’t the case as of July 2025, however, as NUPL is showing rising investor conviction, with no signs of panic selling, suggesting a healthier and more sustainable rally.

Related: Will XRP hit new highs as Ripple participates in US Senate Web3 summit?

The metric appears to have been reinforcing Brandt’s view that XRP is forming a stronger base for a potential climb toward $4.47.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.