Wedbush Securities is betting big on the research prowess of top tech analyst Dan Ives with the launch of a new AI-focused ETF.

The exchange traded fund created around celebrity Wall Street analyst Dan Ives’ top 30 AI picks is off to a strong start.

The ETF has raked in nearly $400 million since its June 3 inception and is up 11%. For the month, its 5% gain is outperforming the Nasdaq Composite and S&P 500.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| IVES | NO DATA AVAILABLE | – | – | – |

Ives is pushing investing in the next generation of artificial intelligence winners via this ETF.

In a first of its kind, the IVES AI Revolution ETF mirrors the proprietary research of Dan Ives, the managing director and global head of technology research at Wedbush Securities.

“In 25 years covering tech, I’ve never seen a bigger theme than the AI revolution,” Ives told FOX Business last month. “And we’ve tried to capture in our research the 30 companies in tech that best encompass this fourth industrial revolution theme across semi-software, infrastructure and autonomous. And that is really the inception. The AI revolution ETF.”

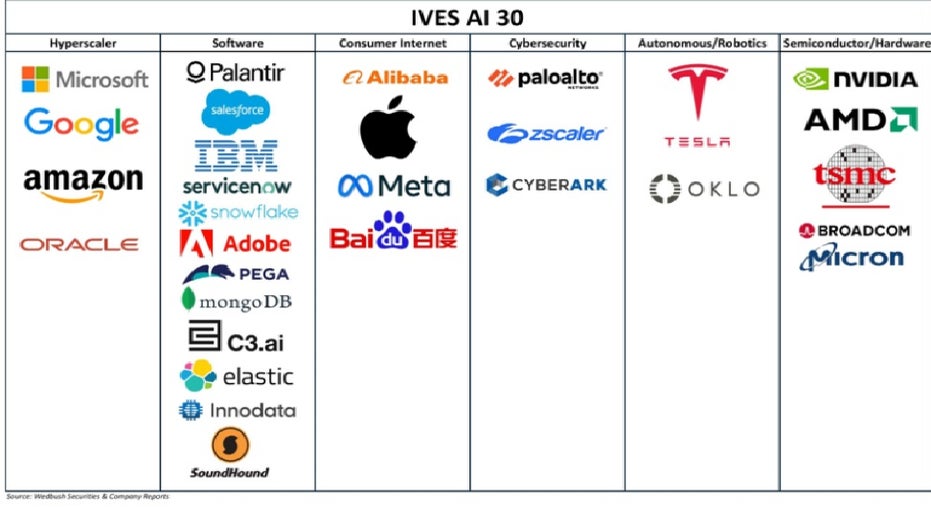

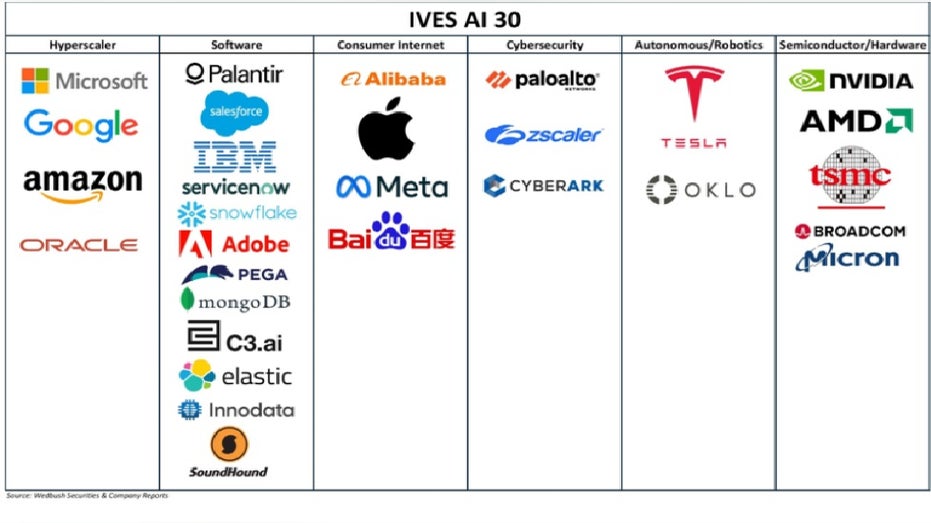

The AI Revolution Theme; 30 Names to Play in the 4th Industrial Revolution. (Wedbush Securities )

Microsoft, Palantir, Meta, Tesla, Palo Alto and Nvidia are just a handful of names driving trillions in spending that began with the rollout of ChatGPT in 2022 and is being powered by AI chip giant Nvidia.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 513.71 | +2.83 | +0.55% |

| PLTR | PALANTIR TECHNOLOGIES INC. | 158.80 | +3.94 | +2.54% |

| META | META PLATFORMS INC. | 712.68 | -2.12 | -0.30% |

| TSLA | TESLA INC. | 316.06 | +10.76 | +3.52% |

| PANW | PALO ALTO NETWORKS INC. | 203.27 | +2.11 | +1.05% |

| NVDA | NVIDIA CORP. | 173.50 | -0.24 | -0.14% |

While some of these names are subject to volatility amid trade tensions between the U.S. and China as well as other tariff fears, that has not altered Ives’ view.

META’S BLOCKBUSTER NUCLEAR DEAL

“Tariffs are in the background, and they continue to create some uncertainty, but that doesn’t change our view that this is a fourth industrial revolution,” he added. “Two-trillion dollars is going to be spent over the next three years. Now, I believe we’re still in the bottom of the first inning in terms of this non-inning game for AI. And the second, third derivative beneficiaries of tech are just starting to focus on AI.”

Jensen Huang, co-founder and chief executive officer of Nvidia Corp., holds up the company’s AI accelerator chips for data centers. (Akio Kon/Bloomberg via Getty Images / Getty Images)

The ETF trades under the aptly-named ticker, IVES, is up against some larger players with AI funds, including iShares and ARK Investments as tracked by ETF.com. Assets under management for these funds range from $1-$2 billion.

However, the firm believes it will have an edge with Ives and a fund that has “active insight and passive structure.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| IYW | ISHARES TRUST REG. SHS OF DJ US TECH.SEC.IDX | 179.98 | +0.51 | +0.28% |

| FTEC | FIDELITY COVINGTON TRUST MSCI INFORMATION TECHNOLOGY | 204.94 | +0.56 | +0.27% |

| FDN | FIRST TRUST EXCHANGE TRADED FUND DOW JONES INTERNET INDEX FD | 272.41 | +1.68 | +0.62% |

“I think, when you compare us to the other ones that are kind of tracking these arbitrary, whatever it may be, revenue hurdles or qualifiers based on some third-party having AI in their earnings report, whatever it may be, we’re getting it from the source,” said Cullen Rogers, Wedbush Fund Advisers’ chief investment officer. “I think a lot of them are following trends. We’re trying to define them through Dan’s mouthpiece.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

This is the firm’s first ETF.

*This story originally published on June 4 has been updated to include assets under management in the ETF and performance stats.