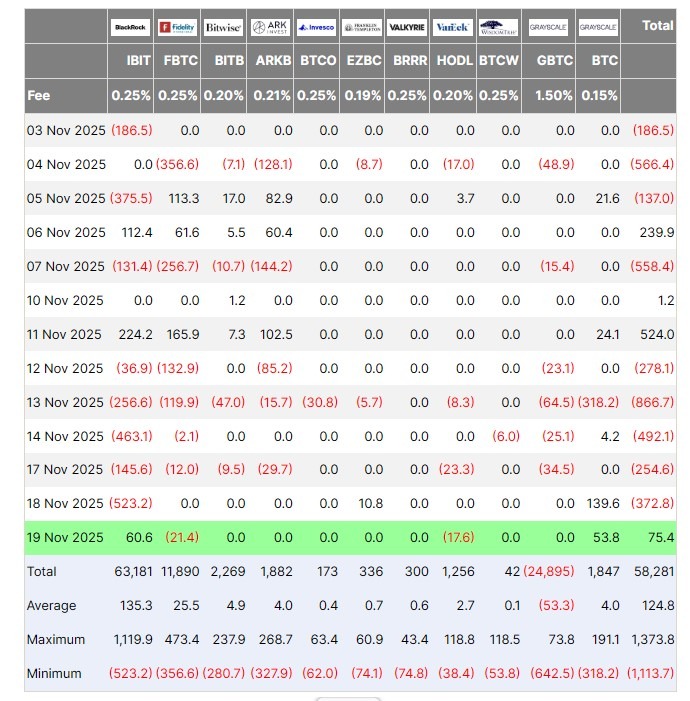

United States-listed spot Bitcoin exchange-traded funds (ETFs) broke a five-day outflow streak on Wednesday, recording $75.4 million in net inflows as Bitcoin reclaimed the $92,000 price point.

Farside Investors data showed inflows led by BlackRock’s iShares Bitcoin Trust (IBIT), which pulled in $60.6 million on Wednesday — still a far cry from offsetting its $523 million in outflows the day before. The Grayscale Bitcoin Mini Trust ETF (BTC) also saw a positive day, contributing $53.8 million in inflows.

On the other hand, Fidelity and VanEck’s spot Bitcoin ETFs saw combined outflows of $39 million on the same day.

The rebound coincided with Bitcoin (BTC) reclaiming the $92,000 level, indicating a slight stabilization after a consistent decline throughout the week.

CoinGecko data showed that BTC reached $92,000 on Wednesday before falling to as low as $88,500 on Thursday. At the time of writing, the asset is trading at approximately $91,700.

Related: Bitcoin recovery expected as liquidity conditions change, but US macro remains a threat

ETFs shed nearly $3 billion in November

The five-day outflow streak, which included over $868 million on Nov. 13 and nearly $500 million on Nov. 14, mirrored the situation across global crypto exchange-traded products in recent weeks.

Farside’s daily breakdown showed that the selling was concentrated. Fidelity’s FBTC saw back-to-back redemptions of $132.9 million and $119.9 million last week. Meanwhile, issuers Bitwise, Ark and Invesco logged multiday stretches of negative flows.

As Cointelegraph previously reported, crypto ETPs saw $2 billion in outflows last week, their highest weekly outflow record since February. CoinShares data showed that within the $2 billion lost, US-based ETPs accounted for 97% of the outflows.

US spot Bitcoin ETFs already shed nearly $3 billion in November, putting the category on track to surpass February as its worst-performing month. According to SoSoValue data, US spot Bitcoin ETFs recorded $3.56 billion in outflows in February.

While a $75 million inflow is modest compared to the recent outflows, it shows a glimpse of returning investment appetite. SoSoValue data also showed that ETF trading volume increased to $6.89 billion on Wednesday, up nearly 18% from the previous day.

This shows that while there’s a broad outflow trend, not all investors are exiting. Some appear to be buying the dip or re-entering ahead of potential year-end catalysts.

Magazine: Crypto carnage — Is Bitcoin’s 4-year cycle over? Trade Secrets