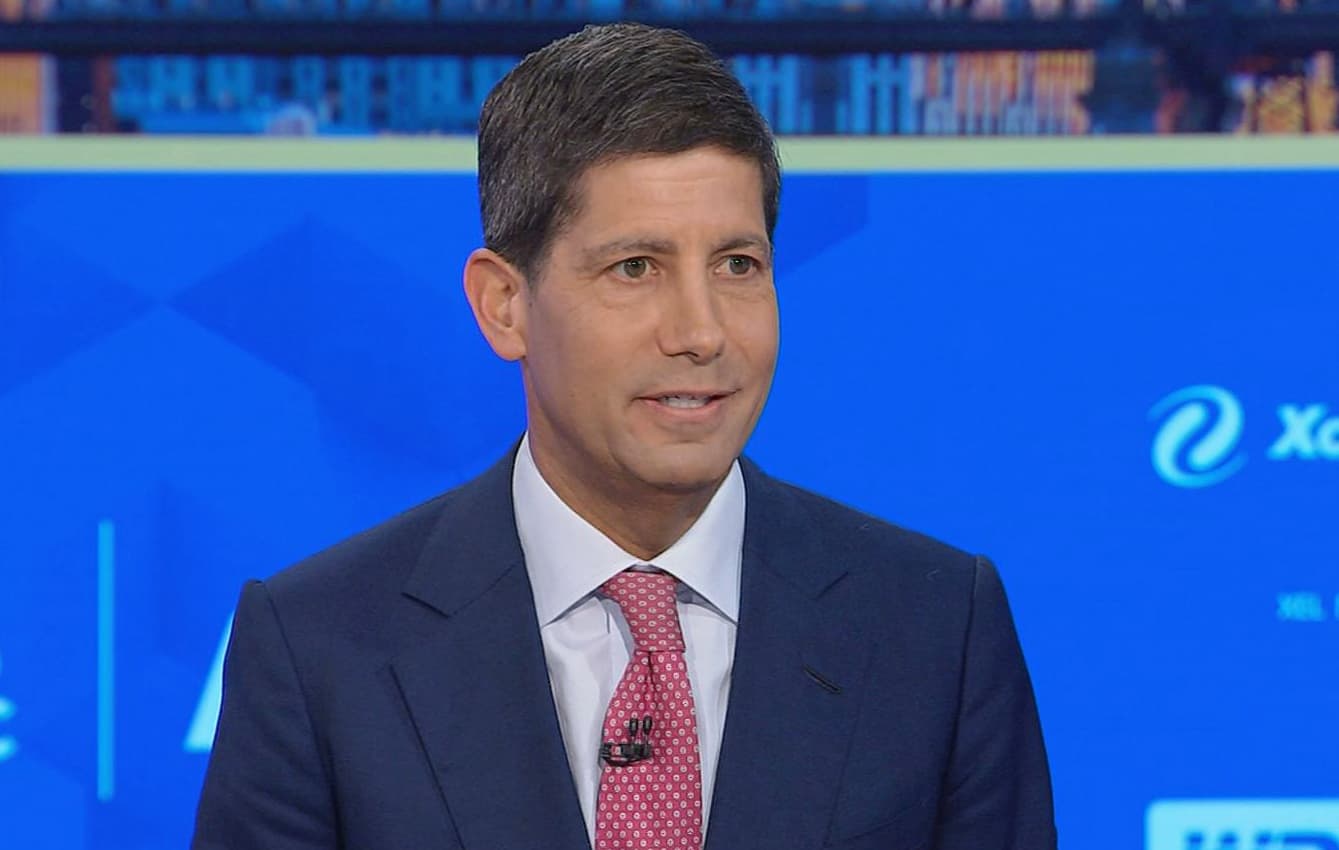

President Donald Trump on Friday named Kevin Warsh to succeed Jerome Powell as Federal Reserve chair, ending a prolonged odyssey that has seen unprecedented turmoil around the central bank.

The decision culminates a process that officially began last summer but started much earlier than that, with Trump launching a fusillade of criticism against the Powell-led Fed almost since Powell took the job in 2018.

“I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best,” Trump said in a Truth Social post announcing the selection.

The pick of Warsh, 55, likely won’t ripple markets because of his past Fed experience and Wall Street’s view that he wouldn’t always do Trump’s bidding.

“He has the respect and credibility of the financial markets,” said David Bahnsen, chief investment officer of The Bahnsen Group, on CNBC’s “Squawk Box.”

“There was no person who was going to get this job who wasn’t going to be cutting rates in the short term. However, I believe longer term he will be a credible candidate,” added Bahnsen.

Stock market futures nevertheless were slightly negative Friday morning, though off their lows since Warsh’s appointment became clear.

Warsh now faces Senate confirmation. If approved, he will take over the position in May, when Powell’s term expires. Warsh will fill the Board of Governors position currently held by Governor Stephen Miran, whose term expires Saturday. Miran can continue to serve until a replacement is named.

‘Regime change’ coming?

Since Powell’s confirmation in 2018, during Trump’s first term, the president has persistently hectored policymakers to lower interest rates aggressively. Even with three successive reductions in the latter part of 2025, Trump kept up the attack, pressing for lower rates and criticizing Powell for cost overruns at the Fed’s massive renovation of its Washington, D.C., headquarters.

Beyond interest rates, Warsh comes to the Fed at a time when policymakers have taken a looser hand on banking regulations. Among the changes, pushed by Vice Chair for Supervision Michelle Bowman, herself once in the running for Fed chair, are lower capital requirements, reducing supervision and supervisory staff, and backing the Fed out of ancillary efforts like pushing banks to prepare for climate events.

For his part, Warsh in a CNBC interview last summer called for “regime change” at the Fed.

“The credibility deficit lies with the incumbents that are at the Fed, in my view,” he said during the July interview. It’s a position that could put him in an adversarial role at an institution where consensus building is key to policy implementation.

Trump’s decision to nominate Warsh comes at one of the most precarious moments for the U.S. central bank in decades — with inflation not fully defeated, government borrowing escalating and the Fed itself facing unusually direct political pressure over how it conducts monetary policy.

Most recently, the Justice Department subpoenaed Powell regarding the construction project. In an uncharacteristically blunt response, Powell charged the move was a “pretext” to push the Fed into following Trump’s orders and ease policy further.

To that end, the nomination comes as questions about Fed independence, a bedrock of central bank credibility, have moved from academic debate into concern. Trump and other administration officials have floated ideas ranging from tighter White House oversight to changes in how the central bank sets rates, including forcing the chair to consult with the president on rate decisions.

“I want to keep it nice and pure, but he certainly wants to cut rates,” Trump said Friday afternoon during an Oval Office session with reporters. He added that he has not talked with Warsh about cutting rates, though the president said that would be a litmus test for candidates.

The nomination ends a competitive derby that at one point included 11 candidates. They spanned from former and current Fed officials to prominent economists and Wall Street pros in an interview process led by Treasury Secretary Scott Bessent. Ultimately, the field was winnowed to five then four, with Trump last week hinting to CNBC that he had arrived at his choice. Among the finalists were current Governor Christopher Waller, BlackRock bond chief Rick Rieder and National Economic Council Director Kevin Hassett.

“Christopher Waller, Rick Rieder, and others, were interviewed for the Fed position. They all would have been outstanding, and have a great and unlimited future with “TRUMP.” Such amazing talent in our Country,” Trump said in a separate Truth Social post.

Rieder, thought to be the favorite as recently as Thursday afternoon, congratulated Warsh on the nomination.

“This has been an incredible honor for me,” Rieder said in a statement to CNBC. “I congratulate Kevin on his nomination and think he will serve the institution and our nation very well.”

Trump praised Hassett and said he was so good at NEC that he didn’t want to move him.

“He is doing such an outstanding job working with me and my team at the White House, that I just didn’t want to let him go,” he said.

In a CNBC interview, Hassett said he was not disappointed and wished Warsh well.

“I’ve got my dream job,” he said. I think President Trump made a great choice, and I’m really thrilled and humbled by all the kind things he said about me. You know, the bottom line is that the economic team in this White House … I think we’ve been hitting on all cylinders, and it’s a really bad time to change teams.”

Political challenges

From here, the nominee faces a tough road.

Republican Sen. Thom Tillis of North Carolina has indicated he will block any Fed nominees until the Justice Department probe is finished.

“Kevin Warsh is a qualified nominee with a deep understanding of monetary policy. However, the Department of Justice continues to pursue a criminal investigation into Chairman Jerome Powell based on committee testimony that no reasonable person could construe as possessing criminal intent,” Tillis posted Friday on social media site X.

“My position has not changed: I will oppose the confirmation of any Federal Reserve nominee, including for the position of Chairman, until the DOJ’s inquiry into Chairman Powell is fully and transparently resolved,” he added.

Hassett told CNBC that the DOJ issue “could get resolved quickly. The White House is highly, highly confident that Kevin Warsh is a great nominee and that he should be confirmed as soon as possible, and every single resource we have at our disposal is behind him, and behind that outcome.”

The nomination gained support elsewhere in Congress. Sen. Tim Scott, R-S.C., who chairs the Senate banking committee, praised Warsh’s “deep knowledge of markets and monetary policy that will be essential in this role.”

“The Federal Reserve’s decisions touch every American household, from mortgage rates to retirement savings, and President Trump has been clear that bringing accountability and credibility to the Federal Reserve is a priority, and his nomination of Kevin Warsh reflects that focus,” Scott said.

The issues, though, are more than political.

Though Trump has insisted that inflation has been vanquished, it remains a good deal from the Fed’s 2% target. At the same time, the labor market has slowed, with the economy current in a no-fire, no-hire climate that poses another challenge to Fed policy.

In any event, markets don’t expect much action from the new chair: Traders are pricing in at most two more cuts this year before the benchmark fed funds rate lands around 3%, which policymakers have indicates is the long-run “neutral” rate that neither boosts nor hinders economic growth.

Then there’s the issue of what happens with Powell.

Though chairs historically have resigned their Fed positions after being removed as chair, that may not be the case this time around. Powell has two years remaining in his governor term, and he could choose to serve it as a bulwark against Trump’s efforts to compromise Fed independence. The Supreme Court already is weighing Trump’s move to unseat Governor Lisa Cook, a case that ultimately could decide what powers a president has over Fed board members.