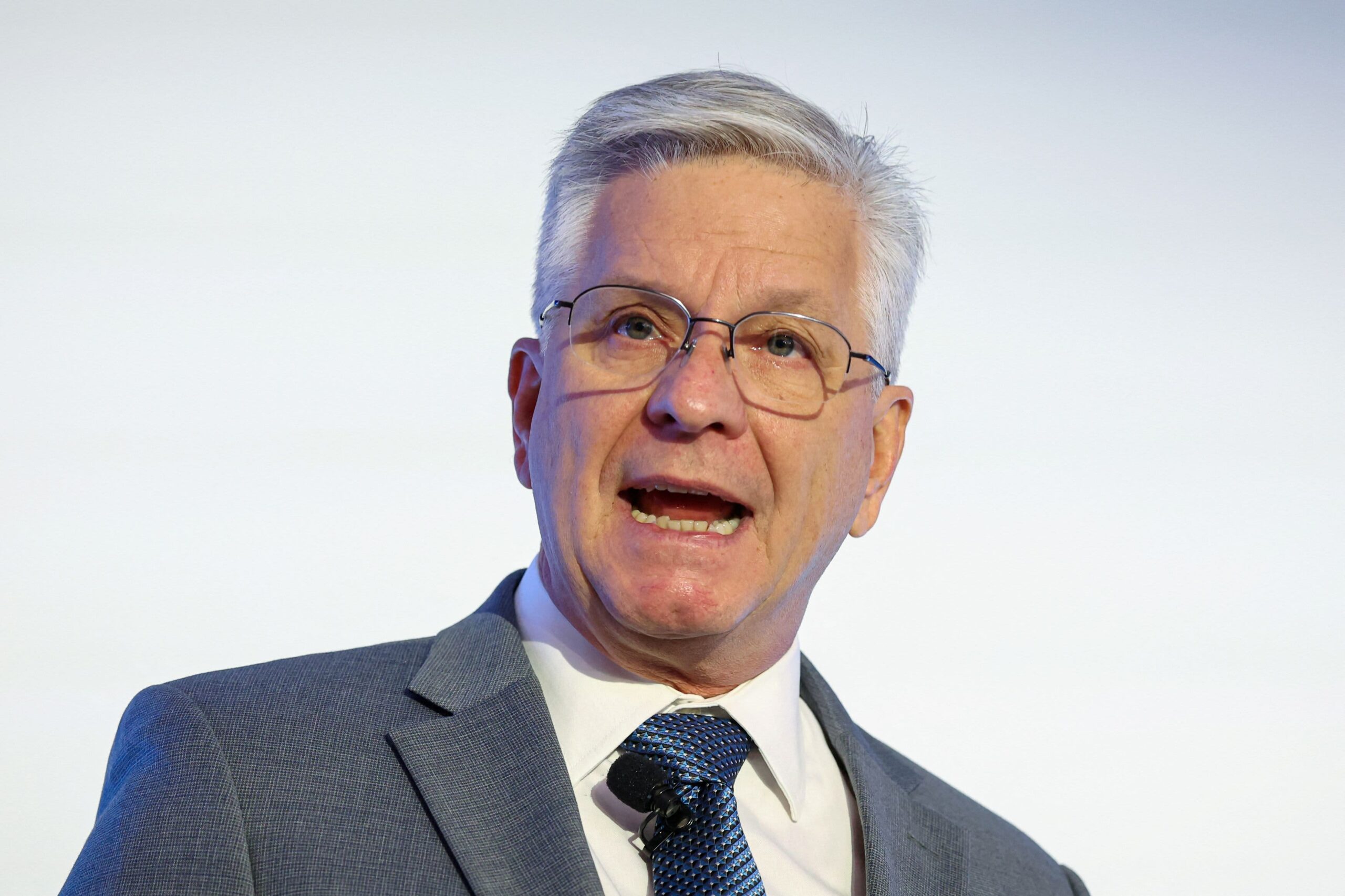

Stephen Miran, President Donald Trump’s nominee for the open Federal Reserve Governor role, vowed to uphold the central bank’s independence as well as its dual mandate — price stability and maximum employment.

“In my view, the most important job of the central bank is to prevent Depressions and hyperinflations. Independence of monetary policy is a critical element for its success,” Miran said in his opening remarks submitted to the Senate Banking Committee ahead of time.

The Senate Banking Committee will hold a hearing on Miran’s confirmation Thursday morning. The chair of the Council of Economic Advisors and a close adviser to Trump is set to fill the last few months of a term unexpectedly vacated by Fed Governor Adriana Kugler. The nominee will serve out Kugler’s term, which expires Jan. 31, 2026. The Fed next decides on rates on Sept. 17.

Miran’s appointment comes amid speculation that Trump would seek to nominate a “shadow chair” whose job it would be mainly to act as a gadfly on the board. Trump said the nominee for the Kugler seat would be temporary rather than a permanent replacement for Powell.

The president has been pushing for sharply lower borrowing costs. Miran has been critical of the Fed in the past, specifically taking issues with its aggressive stimulus during the Covid crisis.

“If confirmed, I plan to dutifully carry out my role pursuant to the mandates assigned by Congress. My opinions and decisions will be based on my analysis of the macroeconomy and what’s best for its long-term stewardship,” Miran said. “The Federal Open Market Committee is an independent group with a monumental task, and I intend to preserve that independence and serve the American people to the best of my ability.”

But Miran also raised some questions about oversight of the Fed in respect to its activities outside of that dual mandate, including the central bank’s balance sheet.

“The Fed oversees the most important global financial institutions. It sets varying prices of money for borrowers and lenders, including other central banks. The ultimate composition of the Fed’s balance sheet is an open-ended question,” he said in the statement.