Strategy executive chairman Michael Saylor has shrugged off concerns that Wall Street’s entry into Bitcoin affected its price action and volatility.

“I think we are getting a lot less volatility,” Saylor said when asked the question during an interview with Fox Business on Tuesday.

Bitcoin (BTC) has fallen nearly 12% over the past week to $91,616, shaving off the gains it’s made so far in 2025, according to CoinMarketCap.

Saylor said that when he began buying Bitcoin for Strategy in 2020, the asset carried an annualized volatility of about 80%. Since then, he said, it has trended lower to now sit around 50%.

He said that every few years, Bitcoin is likely to see another five points of volatility reduced as the asset matures and approaches being around 1.5 times as volatile as the S&P 500 Index, and “1.5 times better performing.”

Strategy’s mNAV sank amid price crash

“Bitcoin is stronger than ever,” he emphasized. Strategy holds 649,870 Bitcoin, worth $59.59 billion at the time of publication, according to SaylorTracker.

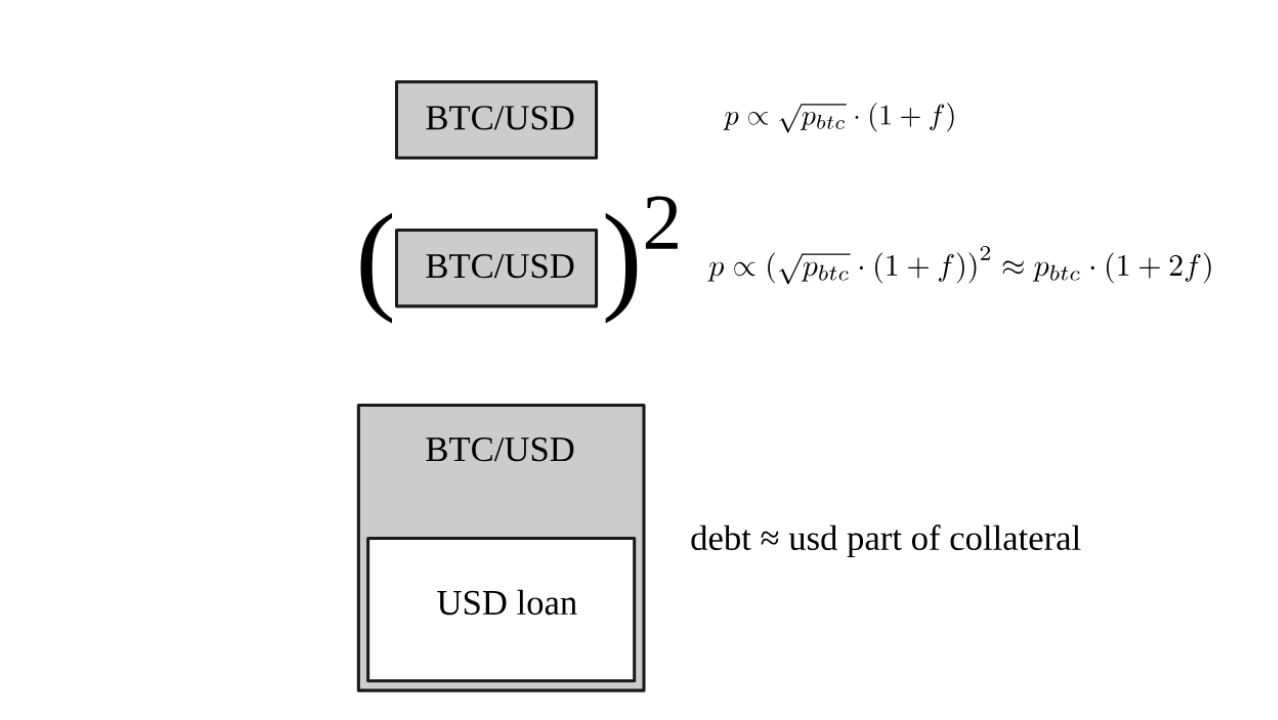

The firm’s mNAV multiple has slipped to 1.11x, down from around 1.52x when Bitcoin hit its all-time high of $125,100 on Oct. 5.

Shares in Strategy (MSTR) often trade at a premium or discount relative to the price of Bitcoin. Along with Bitcoin’s recent price slump, MSTR closed the trading day on Tuesday at $206.80, down 11.50% over the past five days, according to Google Finance.

Saylor isn’t fearful of a major Bitcoin downturn

However, Saylor said he wouldn’t be concerned if Bitcoin were to experience an even more significant downturn.

Related: Bitcoin sinks under $90K: BitMine, Bitwise execs tip bottom this week

“The company is engineered to take an 80 to 90% drawdown and keep on ticking,” he said.

“So I think we’re pretty indestructible,” he said. “Our leverage is in the know, the level of the 10 to 15% going toward zero right now, which is extremely robust,” he claimed.

However, veteran trader Peter Brandt warned that Strategy could be left “underwater” if his thesis of Bitcoin’s chart following the soybean bubble scenario back in the 1970s is correct.

Magazine: Crypto carnage — Is Bitcoin’s 4-year cycle over? Trade Secrets