Robert Kiyosaki took a contrarian view to most crypto analysts on Monday, with a bearish prediction that the Bitcoin “bubble” could soon burst, along with gold and silver.

“Bubbles are about to start busting,” the “Rich Dad Poor Dad” author said on Monday, adding that when these bubbles bust, “odds are gold, silver, and Bitcoin will bust too,” and that’s when he’ll start buying.

The comments follow his earlier remarks while celebrating Bitcoin’s (BTC) all-time high above $120,000 last week, where he said that the new price peak was “bad news for who… for whatever reason… never ‘pulled the trigger,’” because “They own nothing.”

At the time, he also warned not to fall into the trap of overinvesting.

“Pigs get fat, hogs get slaughtered. I am buying one more [Bitcoin]… and get fatter,” he said, later clarifying that he wouldn’t buy any more “until I know where the economy is going.”

His most recent comment, however, appears to conflict with his comment on X in early July, when he criticized “clickbait losers” that keep warning of a Bitcoin crash because “they want to frighten off the speculators.”

Contrary comments on Bitcoin

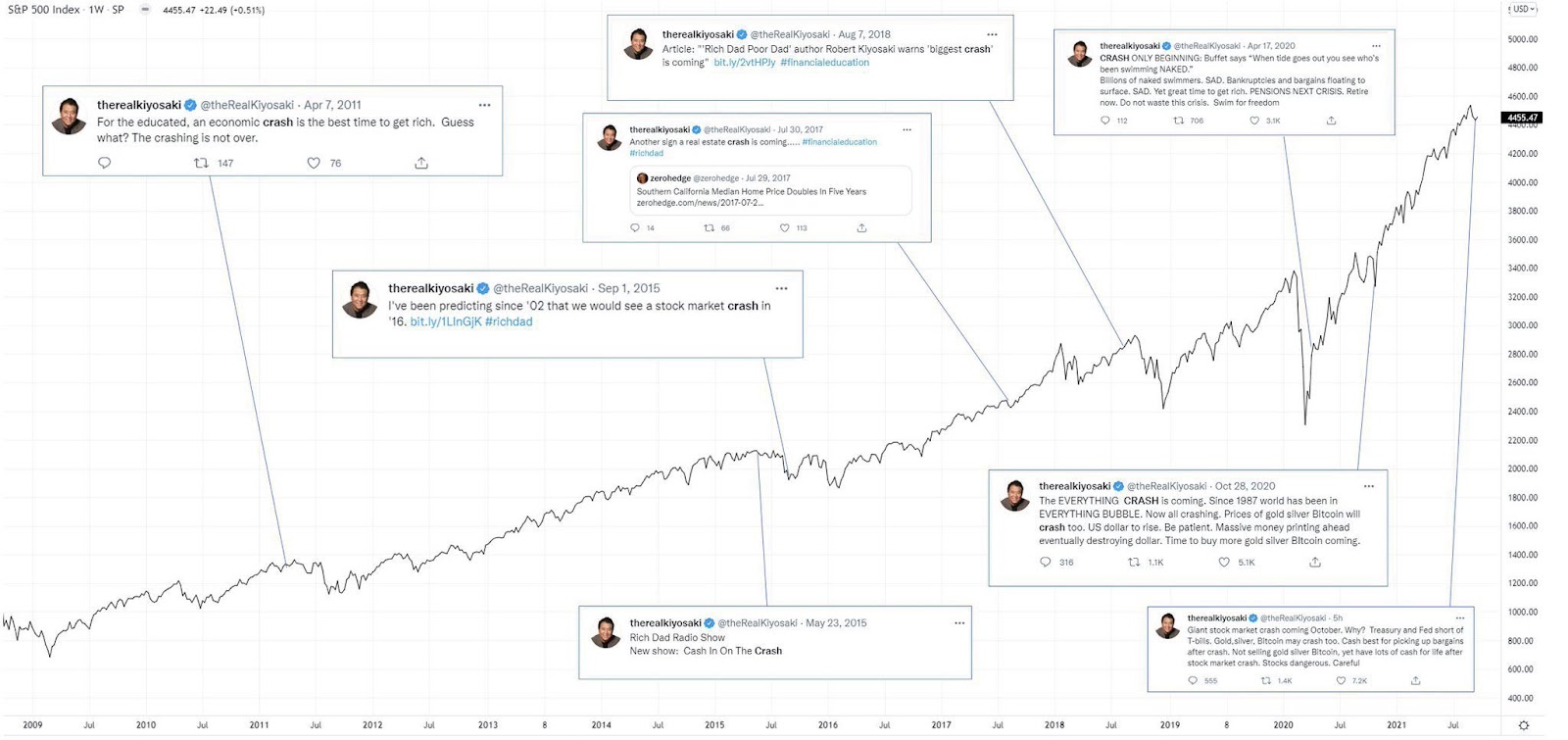

Meanwhile, the market newsletter “Brew Markets” pointed out that Kiyosaki has repeatedly posted about stock and crypto market crashes and has been wrong on several occasions.

Related: Robert Kiyosaki says ditch ‘fake money’ for Bitcoin, gold and silver

There’s also some speculation that Bitcoin treasuries could exhibit bubble characteristics, with many companies facing a potential “death spiral” should BTC prices drop sharply.

However, the director of Bitcoin Strategy, Joe Burnett, said that they were not a bubble because most people still don’t understand the underlying asset, let alone the companies buying it.

Bitcoin treasury companies are not using their capital to experiment, “they’re deploying it immediately into Bitcoin, not into an idea, into money itself,” he said.

Do your own research

Apollo Capital’s chief investment officer, Henrik Andersson, told Cointelegraph that investors would be better off “doing their own research rather than listening to ‘influencers.’”

Meanwhile, NFT collector and founder of the Furyou collection, “Cape,” pointed out on X that Bitcoin has been labelled a bubble and scam every year since its inception.

2009: Bitcoin is a nerd fantasy

2010: Only criminals use Bitcoin

2011: Bitcoin is dead

2012: Bitcoin is dead (again)

2013: Mt. Gox hacked. Told you it was a scam.

2014: Silk Road is gone, RIP Crypto

2015: Blockchain, not Bitcoin

2016: Bitcoin is a bubble

2017: ICOs are a scam…— Cape 👊 (@heycape_) July 21, 2025

Market cycles repeating

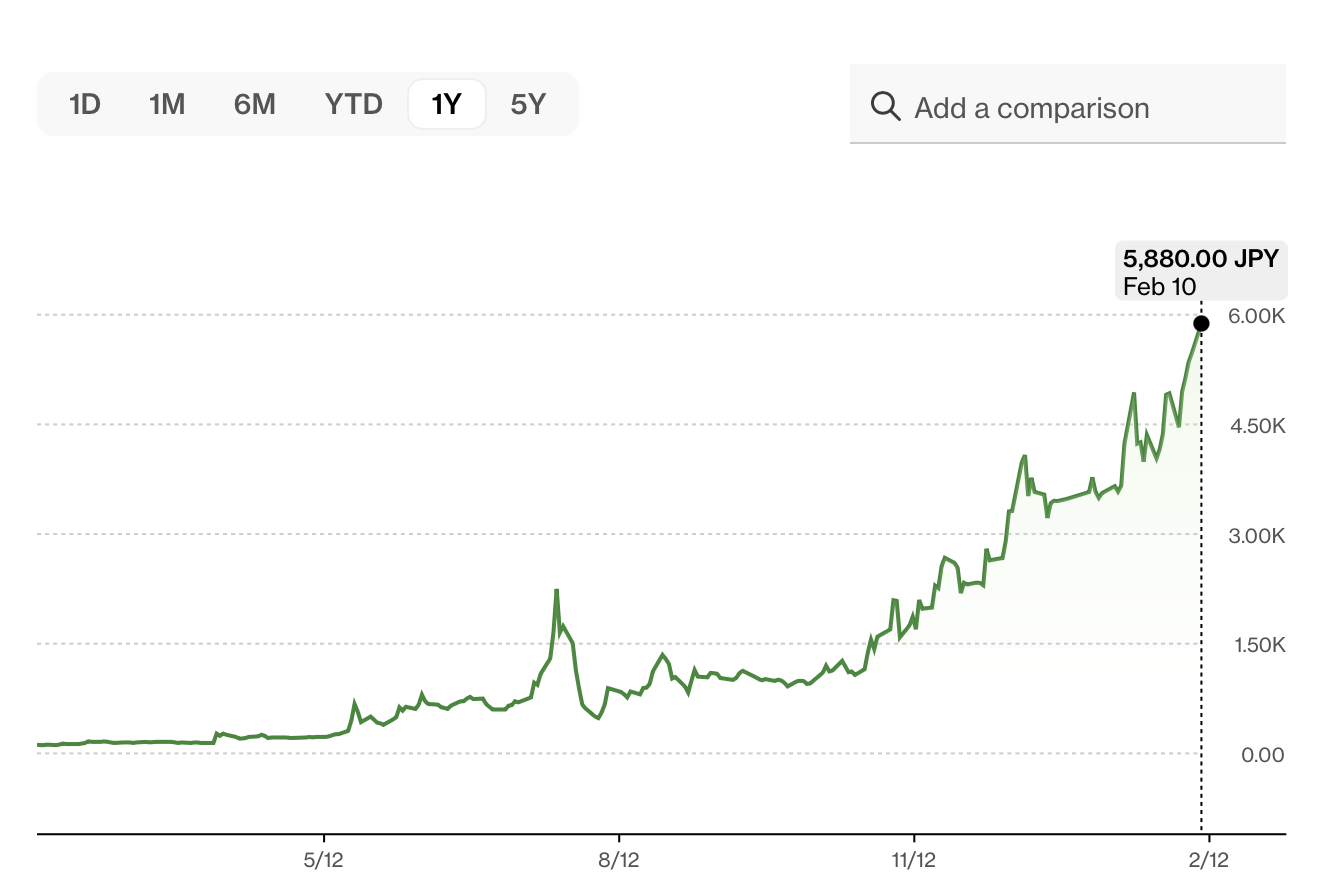

Bitcoin is a cyclical asset with market cycles lasting approximately four years. It has traded within this pattern since inception, and 2025 marks the bull market peak year if history repeats and the cycle pattern continues.

Analysts have predicted that Bitcoin could peak at anywhere between $130,000 and $200,000 before the end of this year.

Additionally, the CoinGlass bull market signal dashboard still suggests that the top is a long way off, with none of the 30 indicators suggesting that the peak is near.

Magazine: Outrage as $1.8B ‘DGCX’ crypto scam ringleader mocks victims: Asia Express