Morgan Stanley has tapped veteran executive Amy Oldenburg to lead the investment bank’s new crypto unit, just weeks after announcing plans to launch three crypto exchange-traded funds and a crypto wallet.

Oldenburg will transition to head of digital asset strategy after working in Morgan Stanley’s emerging markets equity team since 2001, Bloomberg reported on Tuesday.

Oldenburg has been leading the emerging markets team since November 2021, where she was tasked with driving the division’s digital asset strategy.

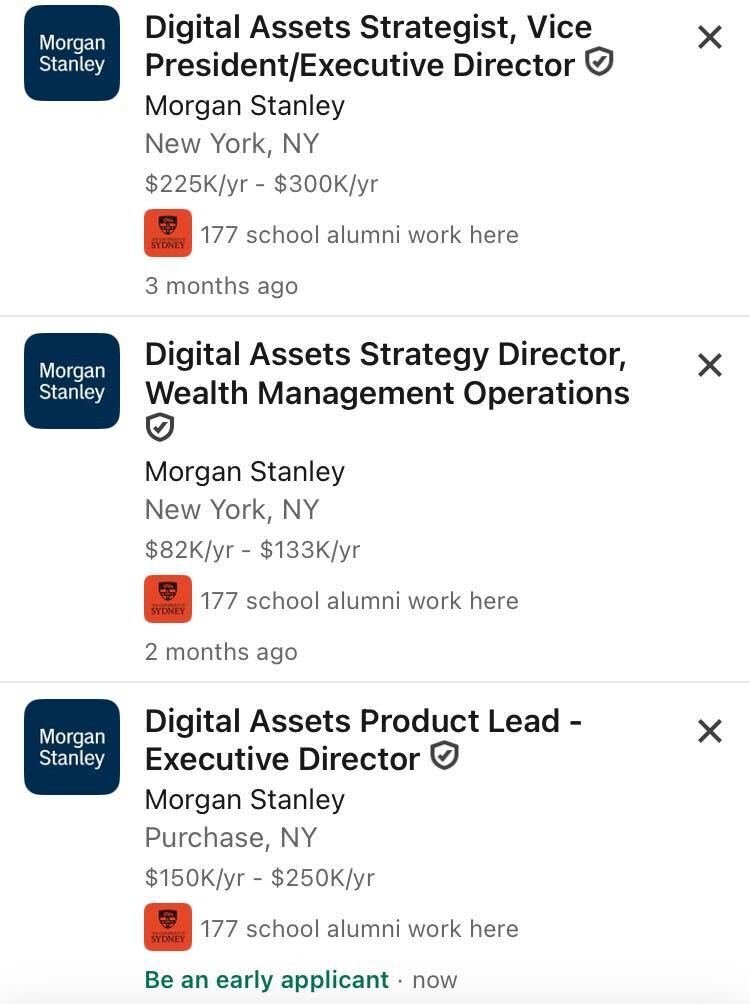

Job listings on LinkedIn show the $2 trillion investment bank is also looking to expand its crypto team, listing positions for digital assets strategy director, digital assets strategist and digital assets product lead.

Morgan Stanley filed to launch spot Bitcoin (BTC) and Solana (SOL) exchange-traded funds in the first week of 2025 — its first major move in the crypto space after largely sitting out the first wave of institutional adoption over the past two years.

Later that week, Morgan Stanley filed for a staked Ether (ETH) ETF that seeks to hold ETH while staking an undisclosed amount to earn staking income.

If approved, the funds could bring new inflows to BTC, ETH, and SOL from Morgan Stanley’s 19 million clients served through its wealth management division.

It is also looking to launch a crypto wallet that would support cryptocurrencies and tokenized real-world assets, including stocks, bonds and real estate.

Oldenburg advocates for crypto self-custody

In past public appearances, Oldenburg has stressed the importance of the “Not your keys, not your coins” concept and the need to build out better self-custody infrastructure, particularly for those in emerging markets. She also stated in March last year that she was “against ETFs” as they didn’t provide staking at the time.

Related: South Dakota lawmaker takes another run at Bitcoin reserve bill

“I want my liquidity 24/7, and also we have clients that want to move assets that they have and potentially bank them with us and be able to leverage all of the features that the digital assets space allows you,” Oldenburg said at the Digital Assets Summit 2025.

Oldenburg was referring to the limitations of ETFs with crypto staking and yield-bearing products at the time; however, the Paul Atkins-led Securities and Exchange Commission has since demonstrated an openness to a broader range of crypto products.

Magazine: One metric shows crypto is now in a bear market: Carl ‘The Moon’