The last penny, nominally valued at $0.01, was minted by the United States Mint in Philadelphia, Pennsylvania, on Wednesday, marking the end of 232 years of new pennies being coined and circulated.

US President Donald Trump directed the US Treasury to stop producing pennies in February, and the Treasury initially set a 2026 target for the last mint. However, the Treasury exhausted the templates used to manufacture the coins between June and September, according to Axios.

A penny costs about 3.7 times its face value to manufacture, meaning that each $0.01 coin actually costs over $0.03.

While it is no longer economically feasible to mint more US pennies, the coin will remain as legal tender, with the more than 250 billion physical pennies continuing to circulate.

“Inflation made the penny useless. Meanwhile, it’s making the sat more relevant every year,” Alexander Leishman, CEO of Bitcoin financial services company River, said, referring to the subunit of one Bitcoin (BTC).

Related: Gold mania? Bank-run style lines at shops as precious metal glitters at all-time highs

Bitcoin as a solution to the erosion of fiat money’s value

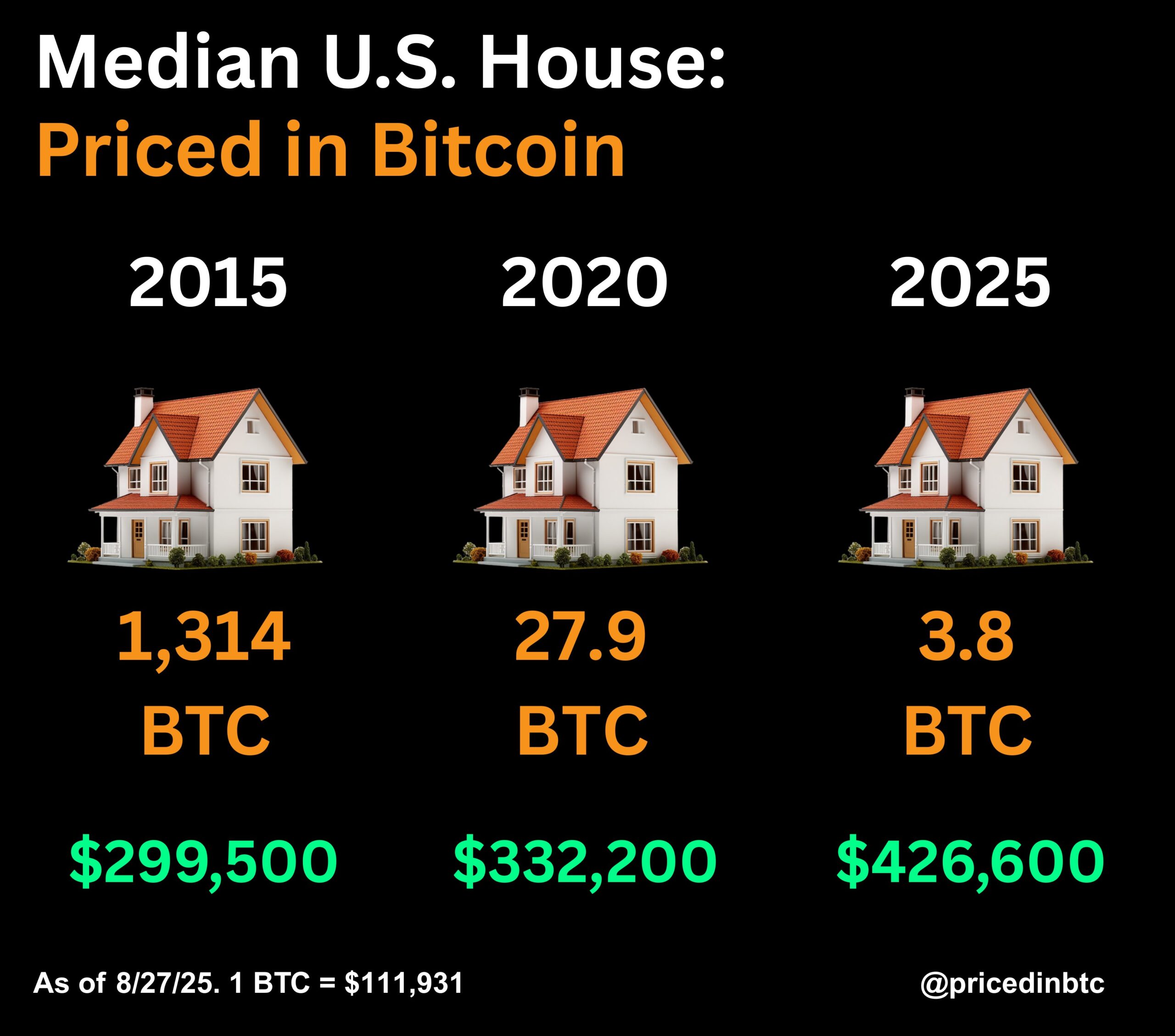

Bitcoin was created as an alternative monetary system that has a supply cap of 21 million coins, meaning that as demand for BTC increases, so should the price per coin.

Technological development is a deflationary force that makes the production process more efficient and reduces the price of goods and services over time, according to author, economist and BTC advocate Saifedean Ammous.

Fiat currencies, in contrast, fail to capture this price deflation because their supply is constantly increasing, resulting in reduced purchasing power over time, which is reflected in the higher prices of goods, assets and services.

In other words, the price of goods and services is not increasing; the value of fiat currencies is declining relative to goods, services and hard assets, according to Ammous.

If those same goods, services, and assets were denominated in BTC or some other hard money standard, prices would go down over time, the economist argues.

The US dollar has lost over 92% of its value since the creation of the Federal Reserve Banking System in 1913, according to precious metals dealer The Gold Bureau.

Meanwhile, Bitcoin hit all-time highs above $126,000 in October, as the US dollar was on track for its worst year since 1973, according to market analysts at The Kobeissi Letter.

“The USD has lost about 40% of its purchasing power since 2000,” The Kobeissi Letter said in October, adding that it lost over 10% of its value year-to-date as of October.

However, economist Paul Krugman, who has long been critical of cryptocurrencies and BTC, said the dollar’s power rests in how easy it is to use, compared to BTC, which is difficult for the average person to hold and transact with.

“The whole point about the dollar is it’s really easy to use, and Bitcoin is not easy to use,” Krugman told podcast host Hasan Minhaj.

Magazine: Baby boomers worth $79T are finally getting on board with Bitcoin