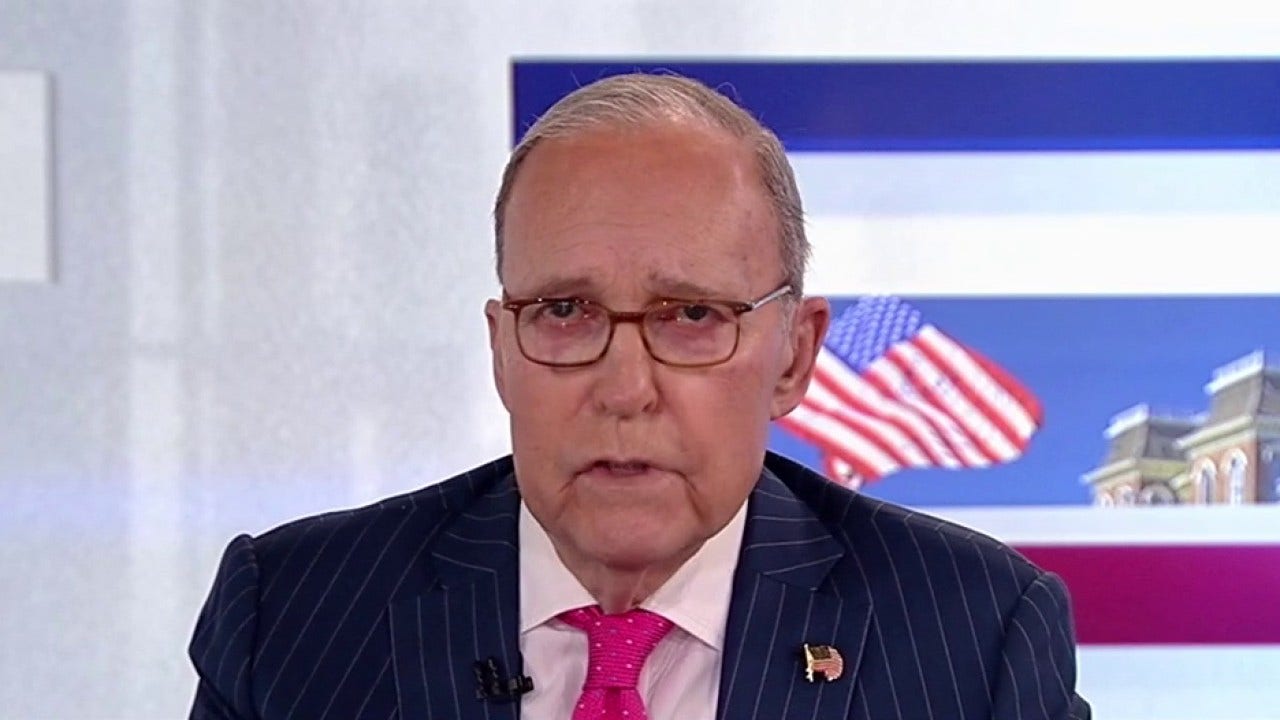

FOX Business host Larry Kudlow resounds growing optimism for the U.S. economy on ‘Kudlow.’

What’s wrong with 5% growth? Or more?

Just to reprise my New Year’s message that a Trump economic boom could deliver 5%, 6%, or even 7% growth, there are numbers out today that are uniformly stronger than even I thought. Economists take note: Mr. Trump knows the economy better than you do. And what’s wrong with 5%, or better, growth?

The Atlanta Fed GDPNow for Q4, which you recall was the shutdown quarter, was revised up to 5.4%. Meanwhile, the productivity of the economy, which is one of the most significant variables, has averaged 4.5% in the last two quarters. That’s output per hour, for the non-farm economy. Perhaps more importantly, non-financial corporate productivity is up 3.8% in the last two quarters. So, productivity trending around 4% opens the door wide-open for 5% (or more) economic growth.

U.S. Ambassador to NATO Matthew Whitaker joins ‘Mornings with Maria’ to discuss President Donald Trump’s Venezuela oil strategy and the national security push behind a potential Greenland acquisition.

And once again, I want to remind everyone about the greatest story never told: sinking oil prices is a positive oil shock, which means it’s like a big tax cut for consumer and business, which is to say Trump deflation is replacing Biden inflation. And a whiff of deflation from oil after nearly 5 years of covid-era, Biden inflation is a very big positive for the economy. Democrats are absolutely frozen in place and paralyzed over the success of President Trump’s economic policies: supply-side tax cuts, deregulation, ‘drill, baby, drill’, and free and fair reciprocal trade.

As the numbers come rolling in, and as Team Trump markets them, the midterm election outlook looks rosier and rosier for the GOP. Treasury man Scott Bessent speaking at the Minnesota Economic Club (is Minnesota Economic Club an oxymoron?) reminded folks about wages and productivity and growth benefits of full expensing for factories, equipment, and farm structures. CapEx business investment spending is running12% through the first three quarters of last year, but not even he seems to apply the positives of falling oil prices that permeate the entire economy.

There are going to be some negative CPI prints coming up. That’s how important energy is. It’s not just gasoline, although that’s softening. There are hundreds of other prices affected by falling petroleum costs. And meanwhile, initial jobless claims keep declining on the four-week average, and the trade deficit in October fell by way more than expected.

Gatestone Institute senior fellow Gordon Chang joins ‘Mornings with Maria’ to discuss China’s backlash to President Donald Trump’s seizure of Venezuelan oil and what it means for U.S. energy dominance and global power.

And here is Mr. Trump and his ‘drill, baby, drill‘ purging communism from the Western Hemisphere in the Trump Corollary to the Monroe Doctrine. And shifting the nexus of oil power from the Persian Gulf to the Americas, right where it belongs.