Consensys founder Joseph Lubin says massive Wall Street adoption of Ethereum will eventually see Ether surge by 100 times and flip Bitcoin as a “monetary base.”

In an X post on Saturday, the Ethereum co-founder said that Wall Street will stake Ether because they currently pay for their infrastructure and Ethereum will “replace much of the many siloed stacks they operate.”

This will lead to massive demand for the asset, and huge increases from current levels, he predicted.

“ETH will likely 100x from here. Probably much more.”

He added that financial institutions will need to become TradFi companies that operate on decentralized rails, and that means staking, running validators, operating layer-2 networks, participating in DeFi, and writing smart contract software for agreements, processes and financial instruments.

Last week, VanEck CEO Jan van Eck called Ether (ETH) “the Wall Street token,” stating banks must adopt the network to facilitate stablecoin transfers or risk falling behind.

Ether has a long road to flip Bitcoin

Lubin said he was also “100% aligned” with Fundstrat Global Advisors managing partner Tom Lee, who said in August that Wall Street will stake and use Ethereum, and that ETH could flip Bitcoin in terms of network value.

“Yes, Ethereum/ETH will flippen the Bitcoin/BTC monetary base,” he said.

Related: Ether breaks below ‘Tom Lee’ trendline: Is a 10% incoming?

However, Ether is still around a quarter of the size of Bitcoin in current market capitalization, meaning it still has a long way to go. Its crypto market dominance has doubled since April though, and is currently 14.3%, according to TradingView.

Ether is the “highest octane” decentralized trust commodity

Lubin, who also chairs the world’s second-largest Ethereum treasury company, Sharplink Gaming, added that Lee “is not nearly bullish enough.”

“Nobody on the planet can currently fathom how large and fast a rigorously decentralized economy, saturated with hybrid human-machine intelligence, operating on decentralized Ethereum Trustware, can grow,” he said, adding:

“Trust is a new kind of virtual commodity. And ETH, the highest octane decentralized trust commodity, will eventually flippen all the other commodities on the planet.”

“Joseph Lubin’s prediction of Ethereum flipping Bitcoin’s monetary base is resonating with institutional clients, who are increasingly allocating treasury assets to ETH due to its staking yield potential and role in tokenization ecosystems,” Nassar Achkar, chief strategy officer at the CoinW crypto exchange, said.

While Bitcoin remains the dominant store of value, “Ethereum’s programmability and Wall Street’s adoption of its staking and DeFi rails could accelerate the ‘flippening’ by transforming ETH into both a productive asset and the foundational layer for global financial infrastructure,” he added.

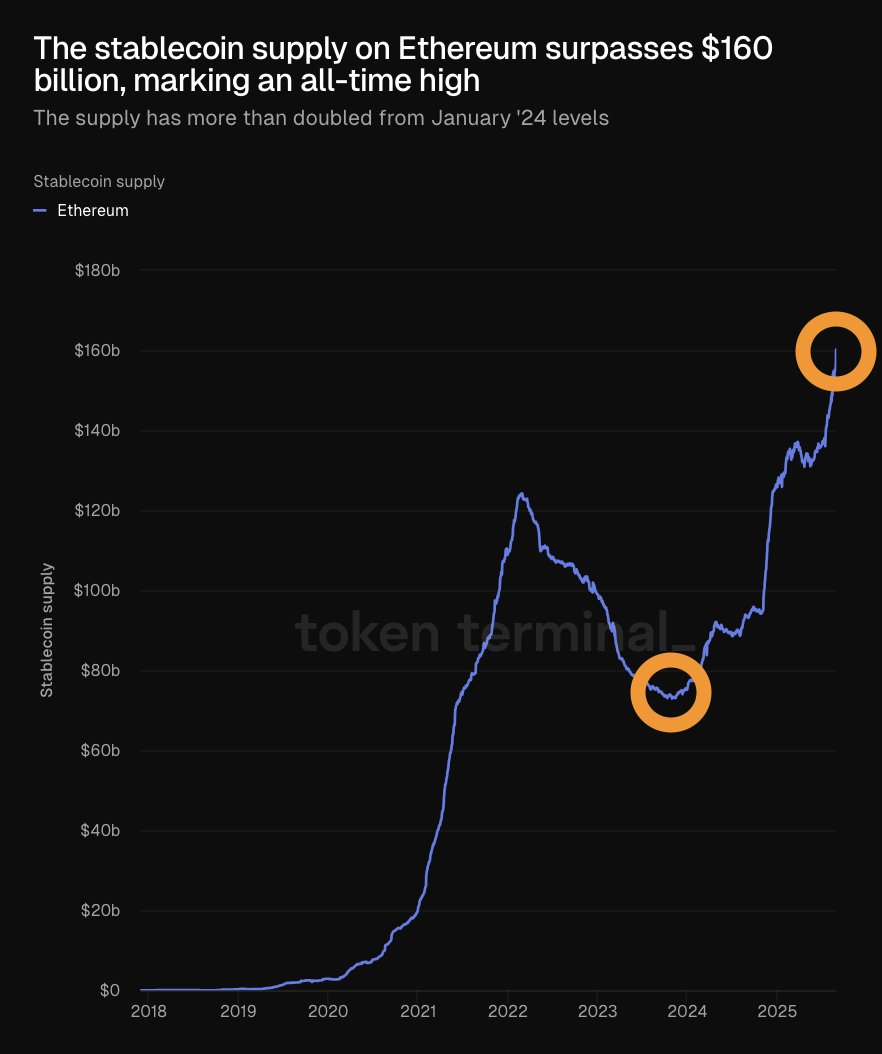

Stablecoins on Ethereum see exponential growth

Meanwhile, the stablecoin supply on Ethereum has surpassed $160 billion, marking an all-time high and more than doubling since January 2024, reported Token Terminal on Saturday.

“Stablecoin demand seems exponential on Ethereum,” commented Tom Lee the following day.

Ether gained over the weekend, approaching the $4,500 level but failed to break resistance there, returning below $4,400 during early trading on Monday morning.

Magazine: XRP ‘cycle target’ is $20, Strategy Bitcoin lawsuit dismissed: Hodler’s Digest, Aug. 24 – 30