How Australian authorities uncovered a $123-million crypto fraud

Australian authorities exposed a crypto crime organization that allegedly laundered $123 million. Four suspects are charged in connection with the scheme.

The discovery is the outcome of an 18-month crypto investigation by Australian authorities. Members of the Australian Federal Police, Queensland Police Service and Australian Criminal Intelligence Commission, along with many other agencies, joined forces to investigate suspicious transactions back in December 2023.

The collaborative entity, Queensland Joint Organized Crime Taskforce (QJOCTF), trailed the money flows of a ring member and found out it was part of a large-scale, sophisticated money laundering scheme that involved front businesses and cryptocurrencies.

Authorities revealed that a total of $123 million was laundered with this complicated scheme. And the laundered money was eventually converted into cryptocurrencies.

Before diving into the modus operandi of the scheme, let’s get started with understanding what money laundering is.

What is money laundering?

Money laundering refers to the process of making illicit money look legal. Criminals launder money to use the proceeds of crimes without drawing attention from authorities.

The process generally unfolds in three stages. The first is “placement” of illegal money into the financial system. Criminals do this by employing commonly used techniques, such as:

- Smurfing: Criminal proceeds are deposited in smaller amounts into bank accounts. The purpose is to keep deposits under a particular sum and avoid reporting.

- Commingling: This technique involves mixing illicit money with legitimate income, usually from a cash-heavy business.

- False invoices: Fake transactions or inflated invoices might be used to justify illicit money flow between companies.

The next stage, “layering,” is meant to further obscure the source of illicit money. The money is moved across accounts and countries or converted into different forms, which makes it harder to trace.

When the money looks clean enough, the “integration” stage kicks in to redistribute money to owners. Laundered money might be used to buy real estate, luxury goods and, in some cases, converted to cryptocurrencies.

To combat money laundering, many countries follow international standards set by the Financial Action Task Force (FATF). These include customer verification rules, reporting of suspicious activity and tighter regulations on cryptocurrency exchanges.

Did you know? The United Nations Office on Drugs and Crime (UNODC) estimates that up to $5.54 trillion was laundered in 2024. This equals around 5% of global GDP.

How an Aussie scam ring used car dealers and crypto to launder illicit funds

Though unsuccessful in the end, the Australian crypto scam ring created a multi-step scheme to evade Anti-Money Laundering (AML) measures.

The ringleader of the crypto scam was a cash-in-transit security company. It used couriers to pick up illicit money at dead drop locations in different cities and carry it to Queensland.

After receiving the money, the security company had to transfer it to its front businesses. To do that, it used an armored vehicle and transported illicit funds together with legitimate money, avoiding raising suspicion.

However, this was only one among many simple steps to obfuscate.

The next step was to move the cash to a classic car dealership that controlled many bank accounts. Car dealerships make perfect front businesses for money laundering, as they regularly deal with large cash payments and can easily hide illegal funds among real sales.

When the dealership got the money, it commingled illicit funds with legitimate earnings during bank deposits. To add a further layer to conceal the source, it transferred money between its bank accounts. The dealership later sent the laundered money to a sales promotion company, which was also part of the ring.

The last step was to deliver laundered money, which was handled by the sales promotion company. It converted part of the proceeds to cryptocurrencies, probably to add another layer to complicate tracing. Eventually, the funds reached beneficiaries in crypto or through third-party businesses.

Aftermath of the Australian crypto investigation

Once the structure was clear, authorities moved quickly to search related locations and bring suspects before the court.

In June 2025, the QJOCTF raided 14 homes and businesses in Queensland. During the operations, authorities seized $170,000 worth of crypto assets, along with $30,000 cash, business documents and devices.

The police also froze 17 properties, cars and funds in multiple bank accounts. The total value of frozen assets is around $21 million.

Four people were charged as part of the Australian crypto investigation: the director and general manager of the security company, a man linked to the sales promotion company and the owner of the classic car dealership.

Each suspect faces serious charges, such as dealing with crime proceeds and forging documents. Maximum penalties range from three years to life in prison.

The investigation is ongoing. Authorities say more people could be charged as they continue to track down links in the broader network.

Crypto’s dark side: A haven for crime?

Crypto’s association with illegal activities is a long-standing and central argument among naysayers. Economist Nouriel Roubini once criticized cryptocurrency exchanges for facilitating money laundering. Meanwhile, Nobel laureate economist Paul Krugman claims that much of crypto activity is criminal.

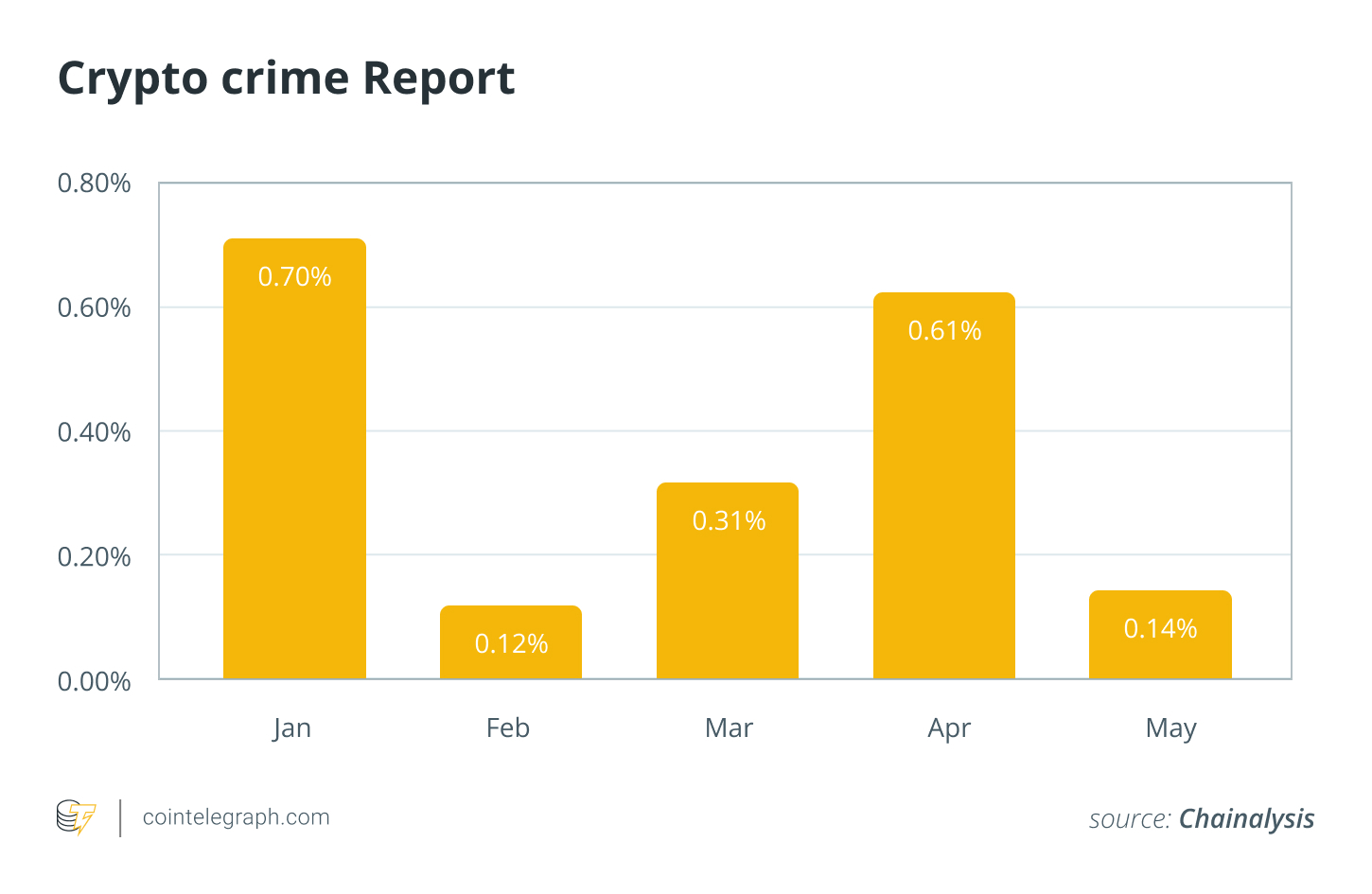

Blockchain analytics firms estimate that illicit crypto volume reached $51 billion in 2024. Yes, that’s a huge number, but it accounts for only 0.14% of the total crypto volume, and the percentage is trending downward.

Crypto may appeal to criminals for several reasons:

- Cryptocurrency transactions are anonymous unless a regulated centralized exchange is involved.

- Blockchains are also global networks that work without intermediaries and allow users to move large sums independently of traditional banking systems.

- Some crypto tools like mixers offer enhanced privacy features as well, which make transactions harder to trace.

Yet the very same features that attract criminals can get them caught by officials. Unlike cash, crypto leaves a permanent trail. Each transaction is recorded on a public ledger, and these records can’t be erased or altered. Blockchain analytics firms and law enforcement can follow these trails across wallets and exchanges to identify culprits.

A US Federal Bureau of Investigation operation carried out in 2023 provides a fine example. The agency was investigating ransomware payments linked to the Caesars cyberattack. The attackers received ransom in cryptocurrency, hoping it would hide their identity. But blockchain’s transparency gave the FBI an investigative edge.

The agency traced the ransom through wallets and realized the funds were sent to two wallets with no transaction history. That alone was strong evidence they were set up just for crypto money laundering, something harder to prove with traditional methods. The FBI followed the trail of blockchain records and eventually froze the assets before they could be cashed out.

As this crypto case shows, blockchain crime is a double-edged sword. What criminals find appealing can easily become the evidence that convicts them.