Bitcoin (BTC) and crypto traders are their most afraid in over six months as BTC price action clings to $100,000.

Key points:

-

Bitcoin and altcoins plunge to their deepest “extreme fear” levels since March this year.

-

Crypto could be nearing a market inflection point, based on sentiment data.

-

Gold steals the show from crypto and stocks as the US government shutdown ends.

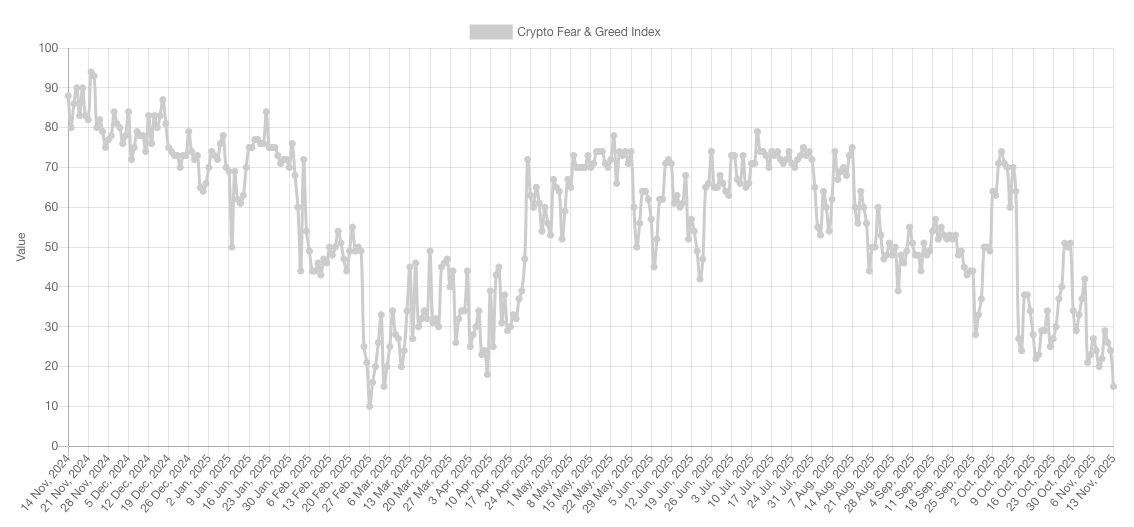

Data from the Crypto Fear & Greed Index on Wednesday confirms that traders are now deep in the “extreme fear” zone.

Bitcoin, crypto sentiment at seven-month lows

Bitcoin may still be trading at six figures with a $2 trillion market cap, but in trading circles, the mood could hardly be more bearish.

The Crypto Fear & Greed Index, which measures market sentiment using a basket of components, now stands at 15/100 — its lowest level since early March.

That number eclipses even the height of panic over US trade tariffs, which centered around April’s “Liberation Day” and saw BTC/USD put in a local low under $75,000.

“Below 20? I’ve never seen this indicator that low,” trader and analyst BitQuant wrote in a reaction on X.

“Retail must have already left the market.”

BitQuant referred to a lack of participation by smaller crypto investors — a characteristic that has characterized much of the current bull run.

In its latest research, analytics platform Santiment drew similar conclusions, while suggesting that a market turnaround may be due as a result.

“When the crowd turns negative on assets, especially the top market caps in crypto, it is a signal that we are reaching the point of capitulation,” it wrote Tuesday.

“Once retail sells off, key stakeholders scoop up the dropped coins and pump prices. It’s not a matter of ‘if’, but ‘when’ this will next happen.”

Santiment flagged an “even bullish/bearish ratio of social media comments” covering Bitcoin itself, something it described as “significantly lower than usual.”

Gold, not crypto, embraces US government reopening

Crypto sentiment thus continued to diverge from stocks, with the traditional Fear & Greed Index sitting at 35/100 on Wednesday.

Related: ‘Most hated bull run ever?’ 5 things to know in Bitcoin this week

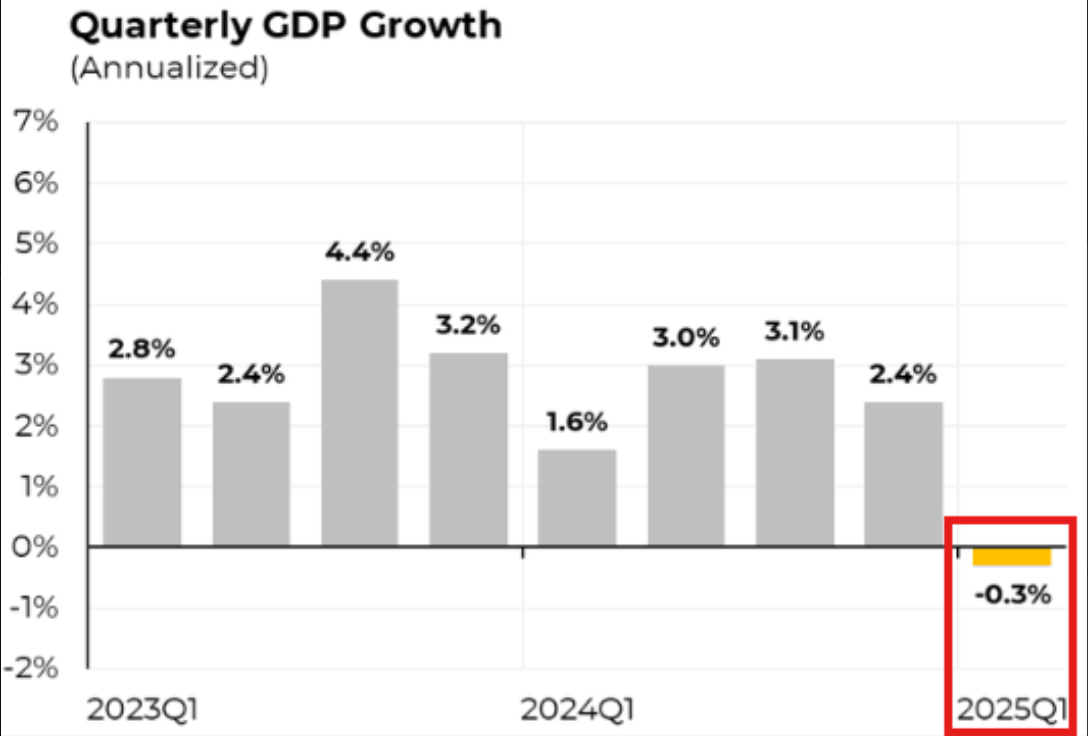

The US government ending its longest-ever shutdown had little impact on market performance, with that eventuality already priced in earlier in the week.

Instead, it was gold and silver in the driving seat, with the former passing $4,200 per ounce and eyeing a retest of all-time highs.

Commenting, trading resource The Kobeissi Letter said that President Donald Trump’s plan to deliver a fresh $2,000 stimulus to Americans was fueling anticipation of fresh liquidity.

“If the $2,000 stimulus checks actually happen, momentum is going to accelerate quickly. Gold and silver always know first,” it summarized.

At the time of writing, BTC/XAU was threatening its lowest levels in over a year, per data from Cointelegraph Markets Pro and TradingView.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.