The venture capital division of America’s largest crypto exchange says it is targeting its funds toward real-world asset trading, decentralized finance and artificial intelligence next year.

In a blog post, Coinbase Ventures stated that it is actively seeking to invest in teams involved in asset tokenization, specialized exchanges and trading terminals, next-generation DeFi and agentic AI advancements.

“These are the categories where we believe the next big breakout companies and protocols will emerge, and where we’re looking to actively invest,” the firm wrote.

Coinbase Ventures has made 618 investments since 2018 and has a portfolio of 422 startups, according to PitchBook. Its most recent was an investment in DeFi compliance platform 0xbow on Nov. 18, while it invested in payment infrastructure firms Zynk and ZAR and prediction markets platform Kalshi in October.

In a thread on X, Coinbase Ventures’ Kinji Steimetz said he expects to see new forms of exposure to real-world assets such as perpetual futures contracts, which “create synthetic exposure to offchain assets.”

He also highlighted the rise of “prop-AMMs” — proprietary automated market makers — a new exchange design that protects liquidity providers from exploitation by sophisticated traders and bots.

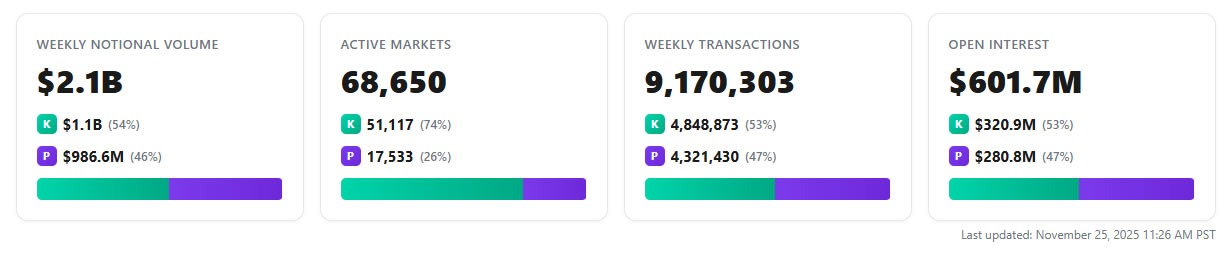

Coinbase Ventures investor Jonathan King predicted the emergence of prediction market aggregators, “which we expect to emerge as the dominant interface layer consolidating $600 million in fragmented liquidity and providing a unified view of real-time event odds across venues.”

Next generation DeFi to emerge in 2026

Integrating perpetual futures exchanges with other DeFi protocols, such as lending, would enable traders to earn yields on collateral while maintaining leveraged positions, unlocking new capital efficiency, said Coinbase Ventures investor Ethan Oak.

Oak also predicted growth in onchain privacy-preserving tools, observing a “surge of developer energy” focused on privacy-preserving assets such as Zcash (ZEC).

Related: DeFi is already 30% of the way to mass adoption: Chainlink founder

Meanwhile, King saw an emergence of DeFi protocols that blend onchain reputation with offchain data to enable unsecured borrowing at scale. “The market opportunity is massive,” he said.

“The US alone has $1.3 trillion in revolving, unsecured credit lines that crypto can capture through superior capital efficiency and global accessibility.”

Agentic AI, DePIN and ‘proof of humanity’ growth predicted

The final three innovations were in the AI sector. There is a gap in training robotic and embodied AI systems, “where available data sets are still limited and fragmented,” said Steimetz.

Decentralized physical infrastructure networks (DePIN) could offer a viable framework for scaling the collection of high-quality physical interaction data for robotics.

“Proof of humanity” solutions, which combine biometrics, cryptographic signing and open standards to verify human versus AI-generated content, would be a growth area in 2026, said Hoolie Tejwani, head of Coinbase Ventures.

Finally, there will be an emergence of AI agent tooling that enables non-technical founders to launch onchain businesses quickly. “2026 might see AI agents further democratize onchain building,” said King, who added that they would be able to handle smart contract code generation, security audits and continuous monitoring.

Magazine: Ethereum’s Fusaka fork explained for dummies: What the hell is PeerDAS?