China’s exports growth beat expectations in June, buoyed by robust shipments to non-U.S. markets and as a temporary reprieve from U.S. tariffs helped slow the decline in goods sent to America.

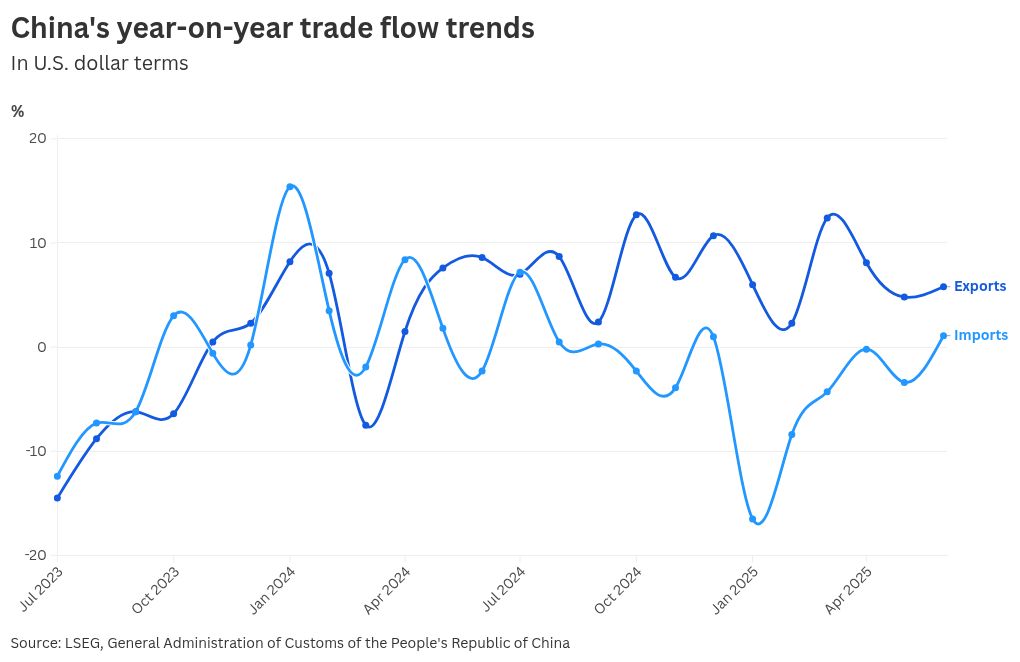

Exports jumped 5.8% in June in U.S. dollar terms from a year earlier, customs data showed Monday, exceeding Reuters’ poll estimates of a 5% rise.

Imports climbed 1.1% from a year earlier. While missing economists’ expectations of a 1.3% rise, that marked the first time that imports have grown this year, reversing the trend of declining imports this year amid sluggish domestic demand.

China’s exports to the U.S. dropped for a third month, falling over 16.1% in June, but the decline eased from the prior month amid a tariff truce. Imports in June dropped 15.5%. That compares with a 34% drop in exports in May, and imports decline of 18%.

The county’s shipments to Southeast Asian nations surged 16.8% from a year ago and those to European Union countries jumped 7.6%, according to a CNBC calculation of the official trade data. Imports from these regions were little changed, rising 0.08% and 0.41%, respectively.

In the first half of this year, Chinese exports jumped 5.9% from a year earlier, while imports slumped 3.9%, customs data showed, with a trade surplus of $585.96 billion — nearly 35% higher from a year earlier.

U.S. President Donald Trump’s tariff policies have prompted Chinese exporters to accelerate efforts to diversify into alternative markets. In April and May, China’s exports appeared resilient, jumping 8.1% and 4.8% year on year, respectively, as surging shipments to Southeast Asian and European Union countries offset the declines in U.S.-bound goods.

Trump’s 145% prohibitive tariffs on Chinese goods briefly took effect in April, with Beijing retaliating with triple-digit duties and other punitive measures, such as export control on critical minerals.

The tentative trade truce struck by both sides in Switzerland on May 12 — that led them to drop a majority of tariffs for 90 days — had nearly derailed, as the U.S. accused China of slow-walking on its pledge to ease restrictions on rare-earth exports while Beijing lashed out on fresh tech export curbs and student visa revocation by Washington.

Ties between the world’s two biggest economies have been on the mend following two days of meeting in London last month, where both sides arrived at a framework to implement the consensus. Beijing agreed to resume shipments of rare earths while Washington offered to ease some export restrictions on ethane, chip-design software and jet engine components.

Both sides are working toward an Aug. 12 deadline to reach a durable deal.

Wang Lingjun, deputy chief of Chinese customs authority, said in a press conference Monday that the Geneva agreement and the London framework were “hard-won” and both sides were accelerating to implement the agreed terms.

U.S. Secretary of State Marco Rubio said last week that he had “constructive and pragmatic” talks with Chinese Foreign Minister Wang Yi, and the odds of Trump meeting Chinese President Xi Jinping were high.

Wang also emphasized that both countries should hold up the consensus reached by their leaders with concrete policies and actions.

Meanwhile, Trump has intensified the talks with other trading partners, leveraging threats of higher tariffs to extract concessions, with an apparent target on curbing trans-shipments linked to China.

Trump said earlier this month that the U.S. would impose 40% tariff on trans-shipments from third countries through Vietnam, a route commonly used by Chinese manufacturers to sidestep tariffs and get goods shipped to the U.S.

China’s exports to Vietnam soared 23.8% last month from a year earlier.

Trump also threatened a 10% charge on imports from countries aligning with BRICS’ “anti-American” policies, which China is a founding member, potentially raising more economic risks for Beijing.

China is set to release its second-quarter gross domestic product growth on Tuesday, with economists polled by Reuters pegging growth at 5.1%, slower than the 5.4% expansion in the first quarter.