BlackRock’s market-dominating spot Bitcoin exchange-traded fund may get bigger after the US Securities and Exchange Commission increased position limits for many Bitcoin funds, according to crypto financial services firm NYDIG.

The SEC on Tuesday increased the number of allowed options contracts from 25,000 to 250,000 “for all ETFs with options,” which includes the iShares Bitcoin Trust ETF (IBIT) but not the Fidelity Wise Origin Bitcoin Fund (FBTC), NYDIG’s global head of research, Greg Cipolaro, said in a report on Friday.

“The change is likely to widen the monstrous lead that IBIT already has over the other players, while it hobbles FBTC’s position as the second-largest options player,” Cipolaro said.

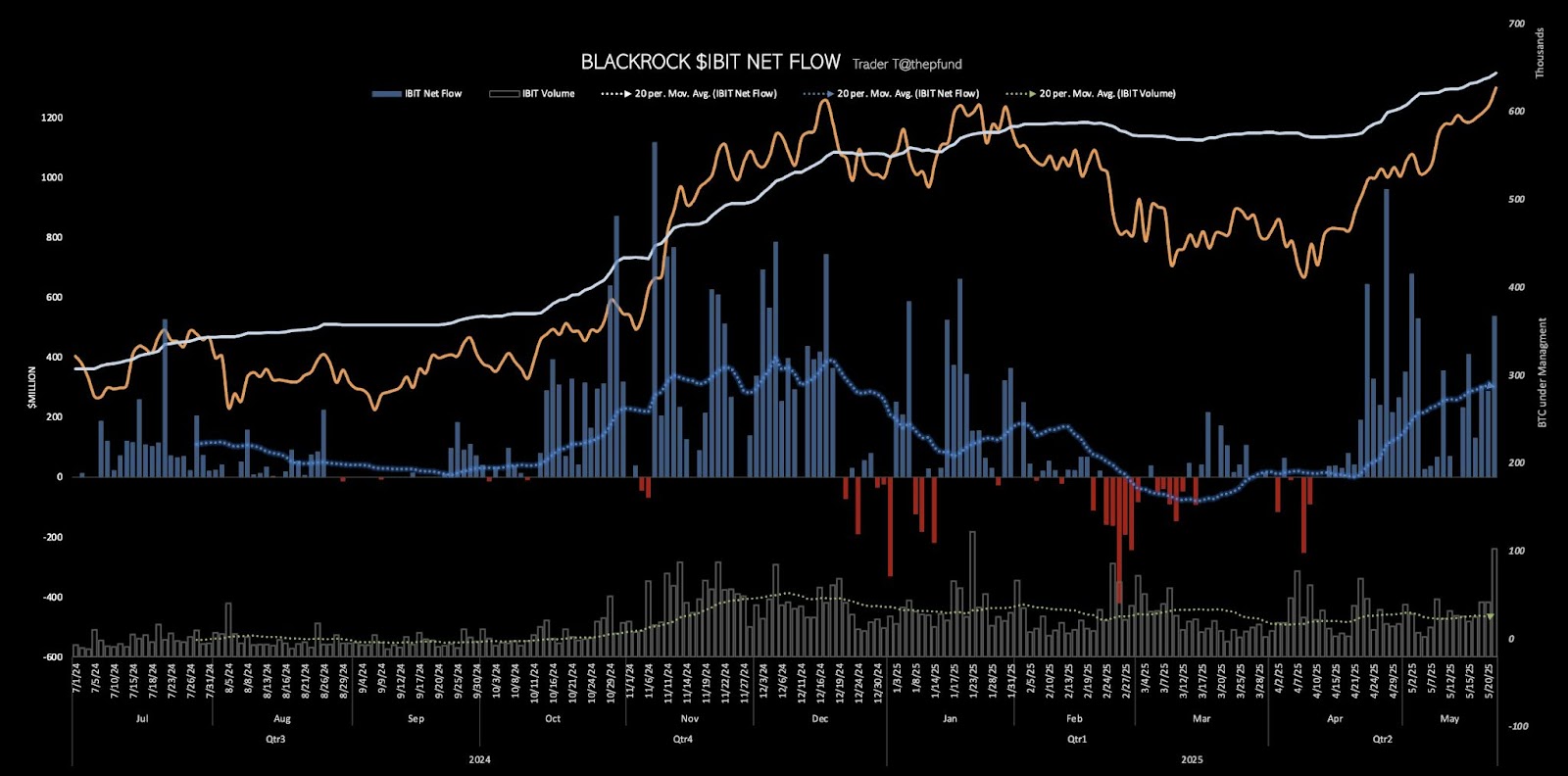

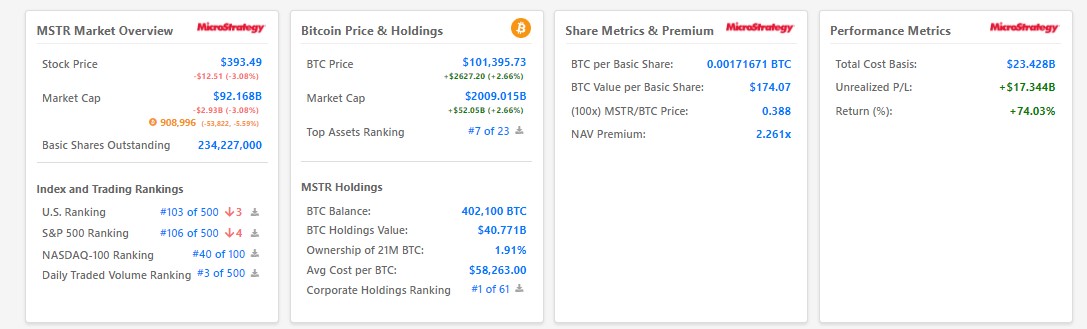

IBIT has $85.5 billion in assets under management, four times as much as FBTC, the second-largest Bitcoin (BTC) ETF by assets with $21.35 billion, according to CoinGlass.

Options limit raise to smooth volatility

Cipolaro said the SEC’s decision to raise options position limits on Bitcoin ETFs would likely suppress Bitcoin’s volatility and lead to more spot demand.

“This change enables more aggressive implementation of options strategies, like covered call selling,” he said, where traders sell a call option while owning the underlying asset, which limits downside risk but also the amount gained from the trade.

Cipolaro added that less volatility makes Bitcoin “appealing on a risk-parity basis, potentially drawing in new capital” from institutional portfolios looking for exposure to balanced risks.

“The feedback loop of falling volatility leading to increased spot buying could become a powerful driver of sustained demand,” he said.

SEC approvals to impact market

The SEC went ahead with a slew of various ETF-related regulatory approvals on Tuesday, most notably approving in-kind creation and redemption on crypto ETFs, allowing the exchange of shares for the underlying crypto instead of cash.

Related: Spot Bitcoin ETFs see second-largest outflow, Ether ETFs end 20-day streak

Cipolaro said this was a “key feature” ETF issuers had wanted before their products were approved, and now that it is, it will “have important impacts on market structure and investor access.”

He added that Authorized Participants (APs) — financial institutions that manage the creation and redemption of ETF shares — which don’t have crypto capabilities “will likely not be able to take advantage of arbitrage activities and offer competitive pricing.”

“There are only two APs today, Jane Street and Virtu, that also have corresponding crypto entities that can trade both sides of the trade,” Cipolaro said, “We expect broker-dealers (APs) that don’t have crypto capabilities to acquire or partner to keep up.”

Magazine: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and governments — Trezor CEO