Key point:

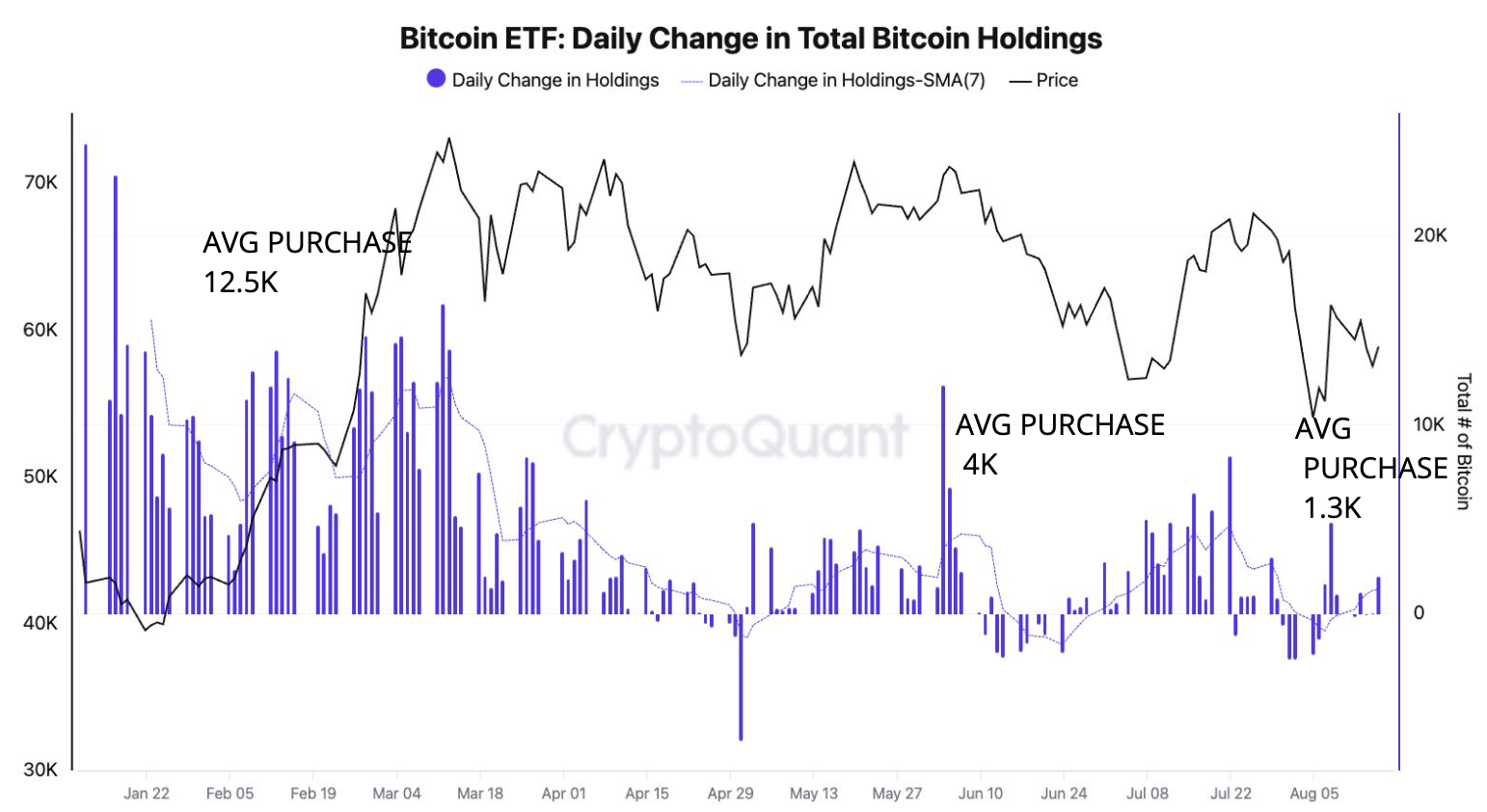

Bitcoin (BTC) pulled back after hitting a new all-time high of $123,218 on Monday, indicating profit-booking at higher levels. The correction seems to be technical in nature, as the underlying demand remains strong. Bitcoin treasury companies purchased 159,107 BTC in Q2, according to BitcoinTreasuries.NET.

The retail investors were not to be left behind. Bitfinex analysts said in a markets report on Monday that demand from Shrimp (1 BTC), Crab (1–10 BTC), and Fish (10–100 BTC) Bitcoin holder groups is at 19,300 BTC per month, which is more than the new monthly supply of about 13,400 BTC since the April 2024 halving.

Could strong demand from institutional investors and retail traders propel BTC toward $150,000? Let’s analyze the charts to find out.

BTC price prediction

BTC is witnessing a correction that could tug the price to the neckline of the inverse head-and-shoulders pattern near $113,000.

The upsloping 20-day exponential moving average ($112,390) and the relative strength index (RSI) near the overbought zone signal an advantage to buyers. If the price rebounds off the 20-day EMA, the bulls will try to push the BTC/USDT pair above $123,218. If they manage to do that, the pair could rally toward the pattern target of $150,000.

Contrarily, a break and close below the 20-day EMA suggests weakening momentum. That may delay the start of the next leg of the up move. The pair may then slide to the 50-day simple moving average ($107,794).

Related: Bitcoin‘s ‘most reliable reversal pattern’ hints at BTC price rally toward $160K

The pair broke below the 20-EMA on the 4-hour chart, indicating weakness in the short term. Buyers are trying to start a relief rally, which may face selling at the 20-EMA. If the price turns down from the 20-EMA and breaks below $115,000, the pair may plummet to the neckline.

Buyers are expected to fiercely defend the zone between the neckline and $110,530. If the price rebounds off the support zone and breaks above the 20-EMA, it suggests that the bulls are on a comeback. The pair may then climb to $123,218.

This positive view will be invalidated in the near term if the price breaks below $110,530. That may sink the pair to $108,000 and thereafter to $105,000. The deeper the correction, the longer it is likely to take for the next leg of the uptrend to begin.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.