Bitcoin (BTC) traders are navigating through one of the fastest capitulation events since late 2022, but one market analyst argued that historical data confirms that $80,000 was the bottom.

Key takeaways:

-

A Bitcoin analyst assigned a 91% probability that BTC will not see a weekly close below the current lows.

-

NVT Golden Cross showed Bitcoin’s market cap may be undervalued, signaling short-term long position opportunities.

-

Macroeconomic liquidity signals from Arthur Hayes and rapid onchain recovery supported the $80,000–$85,000 floor.

Capitulation volume confirmed a high-probability bottom for BTC

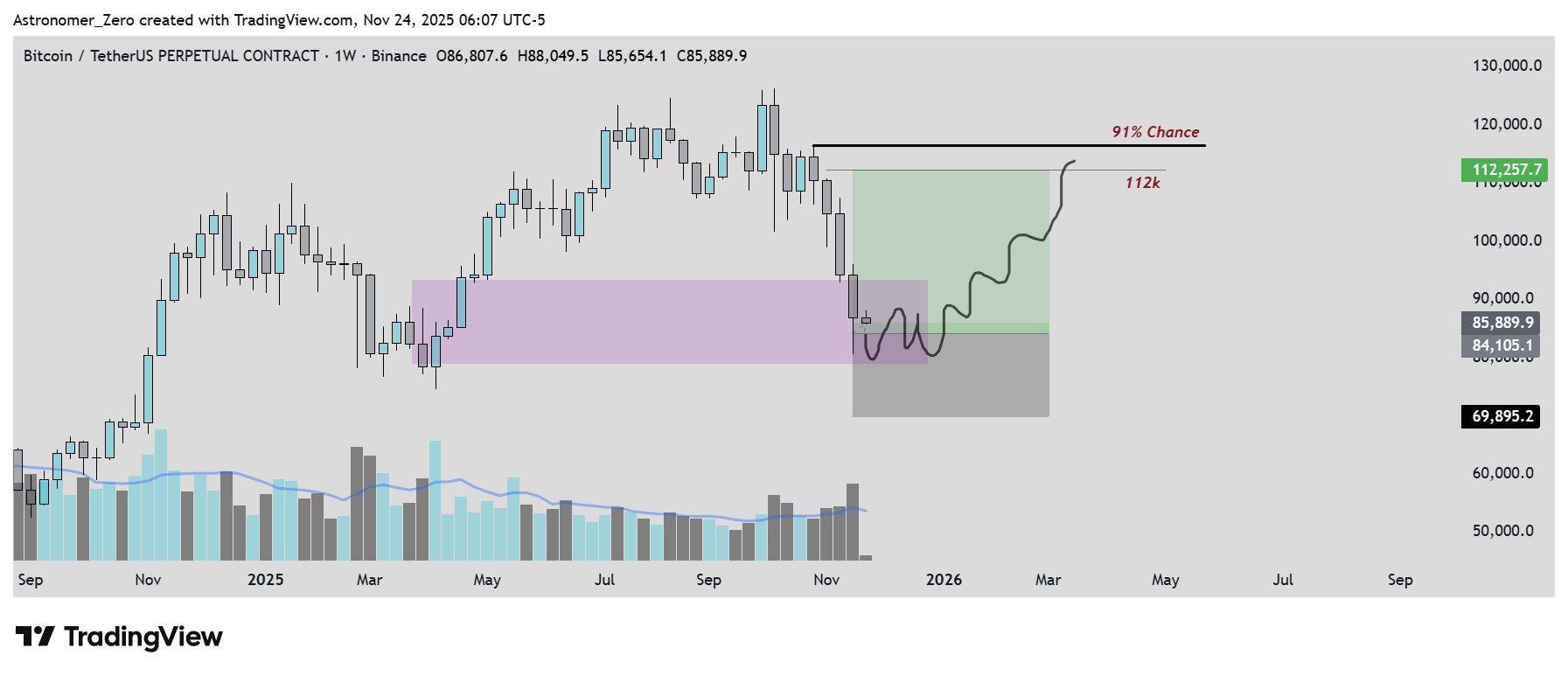

Bitcoin analyst Astronomer said that the ongoing bearish sentiment conveyed to “wait for the trend,” or the claim of a concluding bull cycle, is arising precisely at the wrong time.

According to a capitulation-volume model, based on a layered rule-of-three for weekly candles, it identified prior cycle bottoms when three consecutive high-volume red candles printed before major reversals.

Across 11 historical instances, this same capitulation pattern has produced consistent outcomes. In two out of 11 cases, Bitcoin rallied roughly 35% before any continuation of a broader downtrend.

In eight out of 11 instances, the pattern marked the beginning of a new leg higher, ultimately leading to fresh all-time highs. Only one occurrence resulted in sustained downside, making it the clear statistical outlier.

This forecasts a 91% chance of hitting $118,000 from current prices, a 99% chance of reaching $112,000, and a 75% probability that the broader bull market continues.

Astronomer stressed that sentiment is the real trap; selling now or waiting for trend confirmation aligns with cautious crowd behavior and the risk of chasing the next local high.

Meanwhile, the BTC network value to transaction (NVT) golden cross has dipped to -1.6, typically signaling market undervaluation and a short-term mean-reversion opportunity. However, crypto trader Darkfost warned against using leverage in the current environment.

Related: Strategy stock is bleeding, but Saylor ‘won’t back down’ from Bitcoin bet

Arthur Hayes: “I think $80,000 holds” as liquidity expands

Cointelegraph reported that Arthur Hayes maintained that BTC’s recent 35% drawdown to $80,500 marks the cycle floor, citing an imminent end to the Federal Reserve’s quantitative tightening cycle and rising US bank lending.

As liquidity improves, Hayes expected a “rising-tide effect” for crypto. “We chop below $90K, maybe a stab into the low $80Ks, but $80K holds,” Hayes said, arguing that liquidity expansion, not sentiment, will drive the next leg.

Onchain data supported this narrative. CryptoQuant data noted that BTC just registered the largest net realized loss since the FTX collapse, yet the market flipped back positive almost immediately.

Such fast absorption of forced sellers implies that the floating supply has been flushed, enabling BTC to defend the $80,000–$85,000 zone if traditional market conditions remain stable.

Related: Bitcoin rallies as US dollar strengthens: Are crypto traders walking into a trap?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.