Some prominent financial commentators and investment analysts are predicting a long-term Bitcoin rally that may send the asset’s price above $1 million before the end of the decade, driven by rising inflation and mounting global debt.

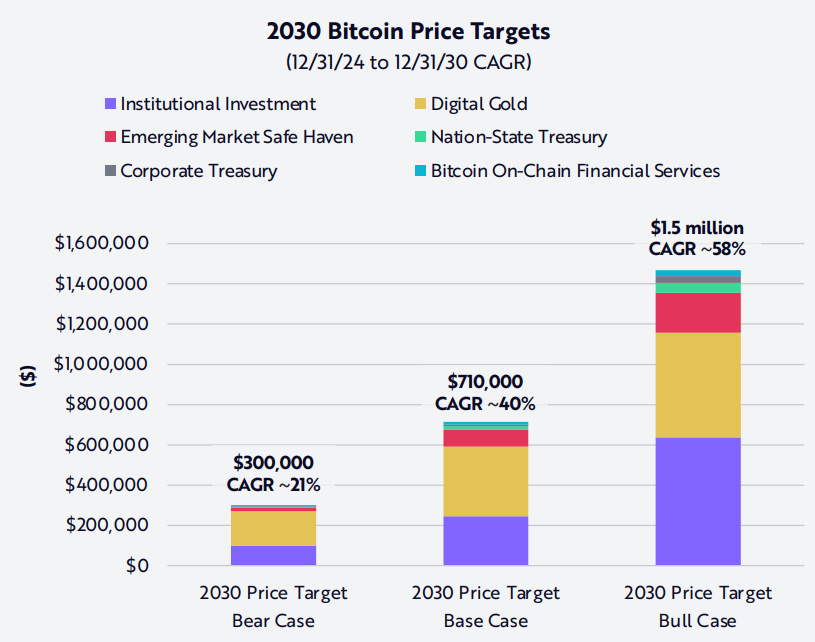

ARK Invest CEO Cathie Wood said Bitcoin (BTC) could reach $1.5 million by 2030 in her firm’s “Bull Case” forecast. In a Feb. 11 video, Wood said the price would require BTC to grow at a compound annual rate of 58% over the next five years, largely fueled by increased institutional adoption.

Related: Bitcoin hits new all-time high of $109K as trade war tensions ease

Robert Kiyosaki, a popular financial educator and the author of Rich Dad, Poor Dad, predicted a more modest Bitcoin price of $1 million by 2035.

“I strongly believe, by 2035, that one Bitcoin will be over $ 1 million, Gold will be $30,000, and silver $3,000 a coin,” Kiyosaki wrote in an April 18 X post, citing the record US federal and credit card debt in 2025 as the main driver for safe-haven assets such as precious metals and Bitcoin.

The rising fiscal debt may lead to the “biggest stock market crash in history,” which could make investors “very rich” if they hedged by investing in “just one Bitcoin, or some gold, or silver,” predicted Kiyosaki.

Related: Bitcoin more of a ‘diversifier’ than safe-haven asset: Report

Other analysts, including Raoul Pal, have pointed to fiat currency debasement as a key reason behind Bitcoin’s appeal as a hedge.

In December 2024, Eric Trump, the son of US President Donald Trump and the executive vice president of the Trump Organization, also predicted that Bitcoin would hit $1 million, citing its potential to “transform the global economy in beautiful ways.”

Analysts target $200,000 in 2025

Bitcoin’s price action historically moves in $16,000 price increments, according to 10x Research’s CEO and head of research, Markus Thielen.

Based on the latest price action, this signals that Bitcoin’s next significant resistance is near $122,000, Thielen told Cointelegraph during the Chain Reaction daily X spaces show on May 22, adding:

“We have been quite bullish over the last five or six weeks. We have been bearish coming out of the Trump inauguration in February, but we turned quite bullish.”

“Open interest is high, but the funding rate is low, which I think indicates that, you know, people try to short this rally,” said Thielen, adding that $122,000 remains the next significant price target to confirm the continuation of Bitcoin’s rally.

Bitcoin may extend its rally to a price top of over $200,000 by the end of 2025, according to Bitwise’s head of European research, André Dragosch.

“Greg Foss, the Canadian Bitcoiner, has put forth a model that can value Bitcoin based on a basket of G20 sovereign bonds,” Dragosch said, adding:

“Based on today’s default probability across all these G20 sovereign bonds, it’s already above $200,000 for Bitcoin.”

He added that growing concerns over sovereign credit risk and institutional inflows could be the catalyst for Bitcoin’s next rally.

Magazine: Arthur Hayes $1M Bitcoin tip, altcoins ‘powerful rally’ looms: Hodler’s Digest, May 11 – 17